MISMO, the real estate finance industry’s standards organization, announced that it is seeking public comment on the SMART Doc V3 eHELOC Specification.

Tag: HELOCs

MBA: Home Equity Lending Volume Stays Relatively Flat in 2023; Debt Outstanding Increases

Total originations of open-ended Home Equity Lines of Credit (HELOCs) and closed-end home equity loans increased in 2023 by 1.5% compared to the previous year, while debt outstandings increased 8.3%.

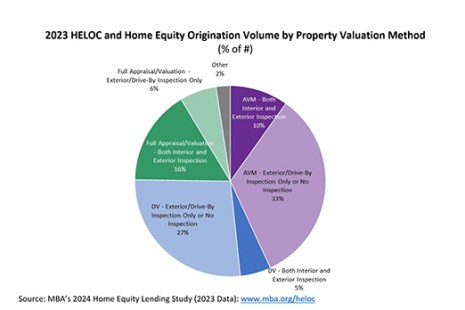

Chart of the Week: 2023 HELOC and Home Equity Origination Volume by Valuation Method

MBA recently completed its 2024 Home Equity Lending Study (covering 2023 data) tracking trends in origination and servicing operations for home equity lines of credit (HELOCs) and home equity loans.

Dovenmuehle’s Anna Krogh: When Unlocking the Potential of Home Equity, Understanding the Servicing Nuances is Key

Home Equity Lines of Credit (HELOCs) provide a flexible borrowing option for homeowners looking to access their home equity, offering an alternative to traditional cash-out refinances, which homeowners may be reluctant to consider if they’re currently holding a below-market interest rate on their primary mortgage.

Reflecting on 2023 Servicing Trends, Anticipating 2024’s: A Q&A With BSI Financial’s Allen Price

MBA NewsLink recently interviewed Allen Price, SVP at BSI Financial, about the trends he saw in the servicing market in 2023, and what he thinks may be to come this year.

TD Bank Survey: Homeowners Plan to Tap Into Equity for Renovations

TD Bank, Cherry Hill, N.J., released its HELOC Trend Watch survey, finding that 38% of homeowners who are renovating their properties within the next two years intend to use a home equity line of credit or home equity loan for funds.

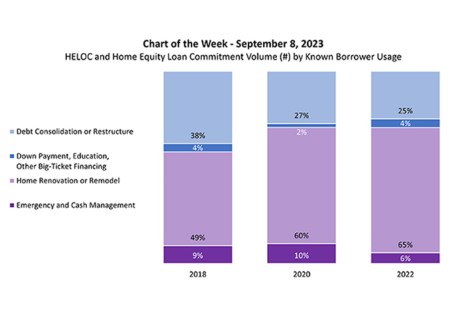

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

Dollar volume of open-end home equity lines of credit (HELOCs) and closed-end home equity loans originated in 2022 increased 50 percent compared to 2020, driven by home renovation or remodeling, according to MBA’s latest Home Equity Lending Study. This week’s Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan, according to participants in our study.

ATTOM: Refis Make Up 2/3 of 2nd Quarter Loans, Highest Level in 7 Years

ATTOM Data Solutions, Irvine, Calif., released its second-quarter U.S. Residential Property Mortgage Origination Report, showing 1.69 million refinance mortgages secured by residential properties (1 to 4 units) originated, up nearly 50 percent from the prior quarter and more than 100 percent from a year ago, to the highest level in seven years.

MBA: Home Equity Lending Growth Hindered by Alternative Products and COVID-19

Home equity loan debt outstanding and borrower utilization rates declined in 2019 and mortgage lenders anticipate originations to fall again this year before increasing modestly in 2021, the Mortgage Bankers Association reported.

ATTOM: 4Q Refinances More than Double

ATTOM Data Solutions, Irvine, Calif., reported 1.27 million refinance mortgages secured by residential property originated in the fourth quarter, up 20 percent from the third quarter and up by 104 percent from a year ago to the highest point since third quarter 2013.