FundingShield, Newport Beach, Calif., released its Q4 2025 fraud analytics report, finding that problematic loans exhibited an average of 3.2 issues per transaction–an all-time high.

Tag: FundingShield

FundingShield: Q3 Saw Record Wire, Title Fraud Risks Per Transaction

FundingShield, Newport Beach, Calif., released its Q3 Wire Fraud Analytics and Risk Report, finding that nearly 46.6% of transactions were flagged for issues posing significant wire and title fraud risks. Each of those loans had an average of 3.1 issues per transaction, a record high and an increase of 35% from Q2.

FundingShield: Transactions With Fraud Risk Nearly Flat From Q1

FundingShield, Newport Beach, Calif., released its Q2 2025 Wire Fraud Analytics and Risk Report, finding 46.63% of transactions were flagged for issues that posed a significant risk of wire and title fraud.

FundingShield: Nearly Half of Transactions at Risk in First Quarter

Nearly 47% of transactions on an $80 billion portfolio of residential, commercial and business purpose loans had issues leading to a risk of wire and title fraud during the first quarter, according to FundingShield, Newport Beach, Calif.

FundingShield: Nearly Half of Transactions at Risk

During the fourth quarter, 45.5% of transactions on a $84.1 billion portfolio comprising residential, commercial and business purpose loans had issues leading to a risk of wire & title fraud, according to FundingShield, Newport Beach, Calif.

FundingShield: Fraud Risk Report Shows Slight Drop

FundingShield, Newport Beach, Calif., found that during the third quarter, 46.43% of transactions on an $82 billion portfolio of residential, commercial and business purpose loans had issues leading to a risk of wire and title fraud.

FundingShield: Fraud Risk Still High in Q2

FundingShield, Newport Beach, Calif., released its second-quarter report, finding that 47.08% of transactions in a $74 billion portfolio including residential, commercial and business purpose loans presented some risk.

FundingShield: Q1 Wire, Title Fraud Risk Remains High

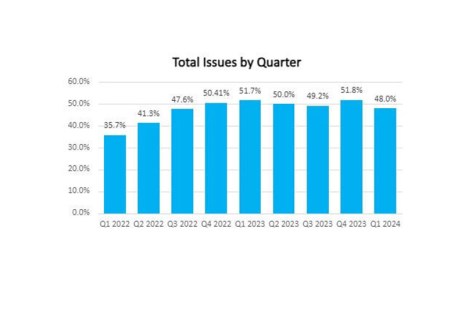

FundingShield, Newport Beach, Calif., reported that wire and title fraud risk dropped somewhat from record-breaking levels hit in the fourth quarter of 2023, but 48% of loans processed in the quarter still exhibit at least one risk factor.

FundingShield: Q4 2023 Analytics Show Significant Risk for Wire, Title Fraud

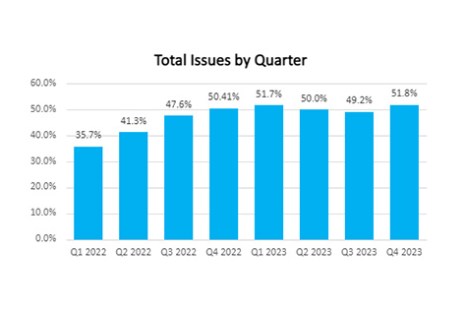

FundingShield, Newport Beach, Calif., reported wire and title fraud risk reached a high of 51.8% of loans on a $61 billion portfolio having at least one risk issue in the fourth quarter.

FundingShield: Concerns of Wire, Title Fraud Still High in Q3

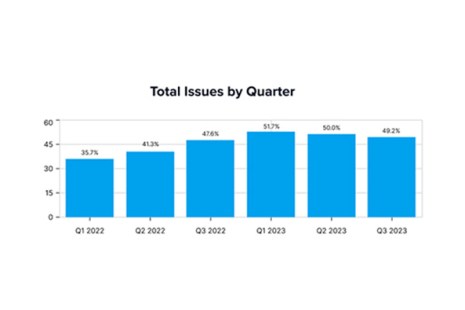

FundingShield, Newport Beach, Calif., reported risks of wire and title fraud remained high in third-quarter data, although fairly flat from the previous quarter.