The Biden Administration on Wednesday announced a number of steps aimed at creating, preserving and selling to homeowners and non-profits nearly 100,000 additional affordable homes for homeowners and renters over the next three years, with an emphasis on the lower and middle segments of the market.

Tag: Freddie Mac

FHFA Raises Proposed 2022-2024 Housing Goals for Fannie Mae, Freddie Mac

Fannie Mae and Freddie Mac have new homework assignments from the Federal Housing Finance Agency, which raise the stakes considerably for the government-sponsored enterprises’ 2022-2024 affordable housing goals

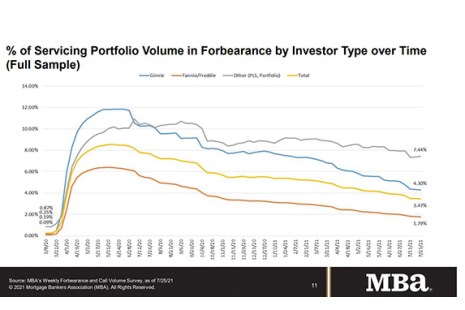

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

MBA MAA ‘Call to Action’ on GSE ‘G-Fees’

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ on Monday to its 70,000-plus members urging them to tell their elected officials to not use government-sponsored enterprise guaranty fees (g-fees) as a source of funding offsets.

MBA, Trade Groups Reiterate Opposition to G-Fee Offsets

Fresh off of last week’s regulatory victory in which the Federal Housing Finance Agency withdrew its controversial adverse market refinance fee, the Mortgage Bankers Association and several dozen industry trade groups took fresh aim at another controversial practice—a move in Congress to use the government-sponsored enterprises’ guaranty fees—known as “g-fees”—to offset funding for non-housing programs.

MBA Asks FHFA for Clarity on GSE Short-Term Rental Policies

The Mortgage Bankers Association, in a July 6 letter to the Federal Housing Finance Agency, asked FHFA for more definitive guidance on the government-sponsored enterprises’ policies on mortgages for properties that include short-term rental units.

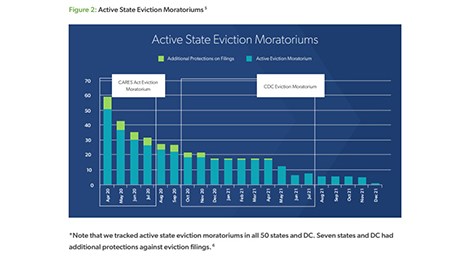

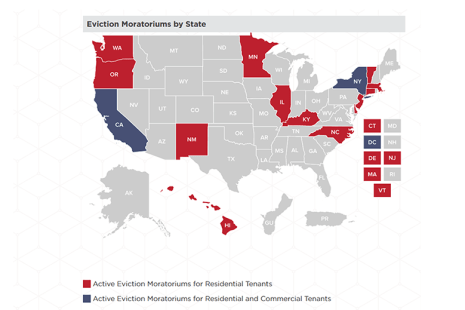

Freddie Mac: Moratoria Staved Off Eviction Crisis During Pandemic

Freddie Mac, McLean Va., said federal and local moratoria in response to the COVID-19 pandemic largely prevented an eviction crisis involving property renters—but the amount of back rent still owed is a “concerning factor” going forward.

CDC Extends National Residential Eviction Moratorium for Final Time to July 31

The Centers for Disease Control and Prevention on Thursday extended its nationwide residential eviction moratorium by another month, to July 31.

FHFA, GSEs Extend COVID-19 Multifamily Forbearance through Sept. 30

The Federal Housing Finance Agency on Thursday said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through September 30

FHFA Announces GSEs’ Proposed Duty to Serve Underserved Markets Plans for 2022-2024

The Federal Housing Finance Agency published proposed 2022-2024 Underserved Markets Plans submitted by Fannie Mae and Freddie Mac under the Duty to Serve program. The proposed Plans cover the period from January 1, 2022 to December 31, 2024.