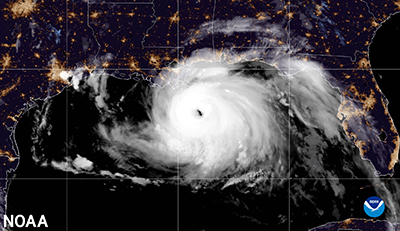

Okay, all you holders of residential and commercial real estate along the Atlantic coast and the Gulf of Mexico: brace yourself for another potential summer of sandbags and insurance claims.

Tag: Freddie Mac

FHFA Announces GSEs’ Duty to Serve Plans for 2022-2024

The Federal Housing Finance Agency published the 2022-2024 Underserved Markets Plans for Fannie Mae and Freddie Mac under the Duty to Serve Program., which outline the government-sponsored enterprises’ commitment to serving manufactured housing, affordable housing preservation and rural housing.

MBA Sends FHFA Recommendations on GSE Seller/Servicer Eligibility Requirements

The Mortgage Bankers Association on Monday sent a letter to the Federal Housing Finance Agency, offering detailed recommendations on the agency’s re-proposal of eligibility requirements for seller/servicers of single-family loans backed by Fannie Mae and Freddie Mac.

FHFA: More than 6.3M Homeowners Helped Since Conservatorship

The Federal Housing Finance Agency released its fourth quarter Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 153,793 foreclosure prevention actions during the quarter

MBA Letter Addresses Concerns About FHFA Strategic Plan

The Mortgage Bankers Association, in comments to the Federal Housing Finance Agency, expressed support for many elements of the proposed FHFA five-year strategic plan while raising concerns on several issues.

FHFA Issues Final Rule Amending GSE Regulatory Capital Framework

The Federal Housing Finance Agency on Feb. 25 published a final rule that amends the Enterprise Regulatory Capital Framework by refining the prescribed leverage buffer amount and risk-based capital treatment of retained credit risk transfer exposures for Fannie Mae and Freddie Mac.

FHFA Re-Proposes Updated Eligibility Requirements for Enterprise Single-Family Seller/Servicers

The Federal Housing Finance Agency on Thursday re-proposed minimum financial eligibility requirements for Fannie Mae and Freddie Mac seller/servicers.

Servicing22: Building Resiliency for Crisis Preparedness

ORLANDO—Perhaps more than any other segment of the real estate finance industry, mortgage servicing had to adapt to the impact of the coronavirus pandemic.

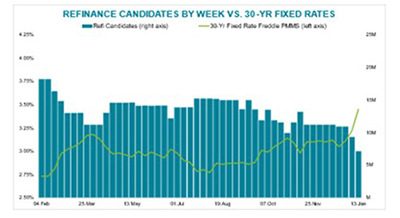

Black Knight: Rising Rates Push Refi Candidates Down to 7.1M

Black Knight, Jacksonville, Fla., said rapidly rising mortgage interest rates have shrunk the number of “high-quality” refinance candidate households to just 7.1 million, the lowest total since November 2019.

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.