Freddie Mac, McLean, Va., plans a pilot program that could replace the current approach to seeking repurchases for performing loans with origination defects. Freddie Mac previewed aspects of the pilot program in October at MBA’s Annual Convention.

Tag: Freddie Mac

MBA NewsLink Multifamily Roundtable: High Rates, Stalled Rents and New Roofs

As uncertainty dominates discussions about getting deals done, MBA NewsLink convened three multifamily finance executives, Chad Musgrove, John Lloyd and Carl McLaughlin, to get their opinions on where the apartment industry sits and where it’s headed next.

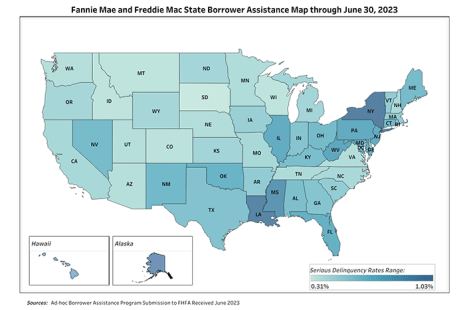

FHFA: GSEs Completed 47,370 Foreclosure Prevention Actions During Second Quarter

Fannie Mae and Freddie Mac completed 47,370 foreclosure prevention actions during the second quarter, raising the total number of homeowners helped to 6.8 million since the conservatorships started in 2008, the Federal Housing Finance Agency reported.

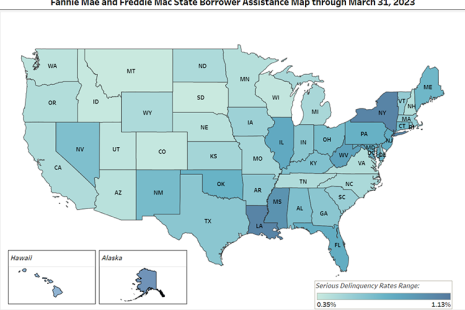

FHFA: More Than 6.7M Troubled Homeowners Helped During Conservatorships

Fannie Mae and Freddie Mac completed 58,268 foreclosure prevention actions in the first quarter, the Federal Housing Finance Agency reported Friday.

MBASecondary23: Solving the Affordability Puzzle

NEW YORK–Affordability is among the top challenges for the housing market. Having strong counterparty relationships and sustainable products helps lenders to better serve the market and maintain liquidity.

FHFA Issues Notice of Proposed Rulemaking on Fair Lending Oversight

The Federal Housing Finance Agency seeks comment on a proposed rule that would formalize many existing practices regarding fair housing and fair lending oversight of Fannie Mae, Freddie Mac and the Federal Home Loan Banks.

FHFA Announces Process for Implementing New Credit Score Requirements; MBA Encourages Members to Complete Survey

The Federal Housing Finance Agency recently requested stakeholder input as Fannie Mae and Freddie Mac replace the Classic FICO credit score model with the FICO 10T and the VantageScore 4.0 credit score models, and transition from requiring three credit reports to requiring two credit reports for single-family loan acquisitions.

FHFA Updates Equitable Housing Finance Plans for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency updated Fannie Mae and Freddie Mac’s Equitable Housing Finance Plans for 2023.

Fannie Mae, Freddie Mac Complete 52,469 4Q Foreclosure Prevention Actions

Fannie Mae and Freddie Mac completed 52,469 foreclosure prevention actions during the fourth quarter, raising the total number of homeowners who have been helped to 6.7 million since September 2008, the Federal Housing Finance Agency reported.

FHFA Delays Effective Date of GSE DTI Ratio-Based Fee to Aug. 1

The Federal Housing Finance Agency on Wednesday said it would delay implementation of certain recalibrated upfront fees for Fannie Mae/Freddie Mac until Aug. 1.