Commercial and multifamily mortgage delinquencies remained low at the end of the first quarter, the Mortgage Bankers Association said in its first quarter Commercial/Multifamily Delinquency Report.

Tag: Freddie Mac

FHFA to Re-Propose Updated Minimum Financial Eligibility Requirements for GSE Sellers/Servicers

The Federal Housing Finance Agency, citing “recent market events,” announced it will re-propose updated minimum financial eligibility requirements for Fannie Mae and Freddie Mac Seller/Servicers.

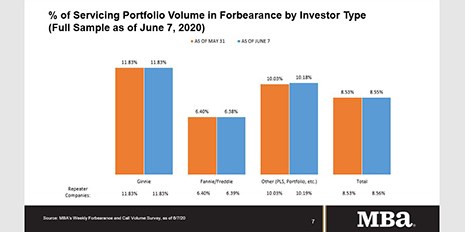

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

FHFA Extends GSE COVID-Related Loan Processing Flexibilities Through July

The Federal Housing Finance Agency extended several loan origination flexibilities currently offered by Fannie Mae and Freddie Mac designed to help borrowers during the COVID-19 national emergency through at least July 31.

FHFA Announces Next Steps for GSE UMBS Pooling Practices

The Federal Housing Finance Agency yesterday directed Fannie Mae and Freddie Mac to “further align their practices for evaluating seller and servicer prepayment related activities.”

Tom Lamalfa: May 2020 Survey of Secondary Market Executives

What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancellation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.

FHFA Publishes Credit Risk Transfer Spreadsheet Tool

The Federal Housing Finance Agency June 2 published a Credit Risk Transfer spreadsheet tool based on the re-proposed capital rule for Fannie Mae and Freddie Mac.

California County Ends Controversial PACE Loan Program

Forget the coronavirus—if you want to raise the blood pressure of a mortgage lender or servicer, just say these two words: “PACE loan.”

To the Point with Bob: FHFA’s Capital Rule and How it Fits into Housing Finance Reform

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, in his newest blog, discusses latest developments involving the Federal Housing Finance Agency and its re-proposed capital framework for Fannie Mae and Freddie Mac.

MBA Vice Chair Kristy Fercho Testifies Before House Subcommittee on Industry’s COVID-19 Response

Mortgage Bankers Association Vice Chair Kristy Fercho testified Friday before a House subcommittee on the real estate finance industry’s response to the coronavirus pandemic, saying mortgage servicers adapted to changing customer needs quickly and asking Congress to give the industry additional flexibility to address evolving market conditions.