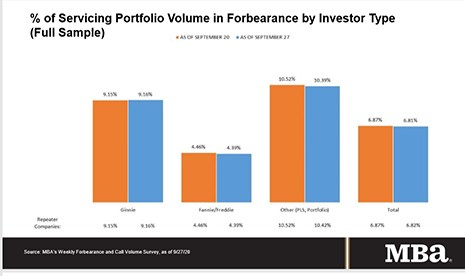

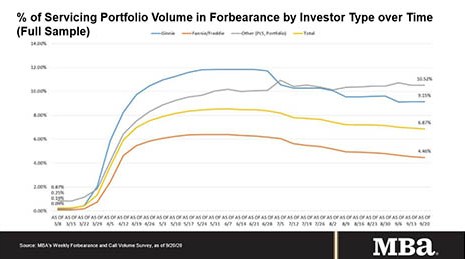

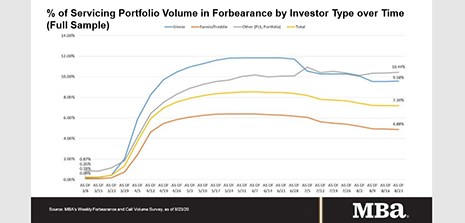

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

Tag: Freddie Mac

MBA: Share of Loans in Forbearance Drops to 6.87%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

FHA: GSEs Complete 252,000 2Q Foreclosure Preventions

The Federal Housing Finance Agency said Fannie Mae and Freddid Mac completed 252,014 foreclosure prevention actions in the second quarter, bringing to 4.68 million the number of troubled homeowners who have been helped during conservatorships.

MBA: Loans in Forbearance Fall to Lowest Level in 5 Months

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Representatives of Fannie Mae and Freddie Mac said lenders thus far have weathered the coronavirus pandemic very well, thanks to lessons learned from the Great Recession.

MBA: Share of Mortgage Loans in Forbearance Declines to 7.01%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.

Mortgage Rates Fall to Record Low

The 30-year fixed-rate mortgage averaged 2.86 percent last week, the lowest rate since at least 1971, reported Freddie Mac, McLean, Va.

MBA Asks FHFA to Develop New GSE Capital Framework

The Mortgage Bankers Association asked the Federal Housing Finance Agency to restructure the capital framework for Fannie Mae and Freddie Mac, moving from past business models to a market utility approach that enables them to meet all of their obligations.

MBA: Share of Mortgage Loans in Forbearance Flat at 7.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the percentage of loans in forbearance stayed flat for the second straight week, holding at 7.20% as of Aug. 23.

GSEs, FHA Extend Foreclosure/REO Eviction Moratoria

The government-sponsored enterprises and HUD announced they would extend foreclosure moratoria to all GSE-backed mortgages and FHA-backed mortgages, respectively and extend eviction moratoria through at least Dec. 31.