The Federal Housing Finance Agency on Jan. 6 published the 2021 Underserved Markets Plans for Fannie Mae and Freddie Mac under the Duty to Serve program. The Plans became effective Jan. 1.

Tag: Freddie Mac

FHFA Issues RFI on Appraisal-Related Policies, Practices, Processes

The Federal Housing Finance Agency on Dec. 28 issued a Request for Input on appraisal-related policies, practices and processes. The input received in response to the RFI will be used by FHFA to determine necessary modifications needed to ensure Fannie Mae and Freddie Mac operate in a safe and sound manner.

FHFA Issues Proposed Rulemaking Notice on GSE Resolution Plans

The Federal Housing Finance Agency on Dec. 23 issued a Notice of Proposed Rulemaking that would require Fannie Mae and Freddie Mac to develop credible resolution plans, also known as living wills.

Fannie Mae, Freddie Mac To Extend Multifamily Forbearance Through Mar. 31

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through March 31, 2021. The programs had been set to expire December 31.

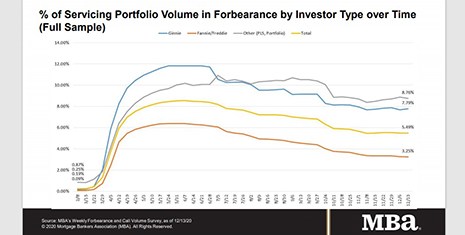

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

FHFA: GSEs Complete 539,000 3Q Foreclosure Prevention Actions

The Federal Housing Finance Agency released its third quarter Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 539,451 foreclosure prevention actions in quarter, bringing to 5.2 million the number of troubled homeowners who have been helped during conservatorships.

FHFA Issues Proposed Rulemaking for Enterprise Liquidity Requirements, Seeks Comments

The Federal Housing Finance Agency, Washington, D.C., on Thursday announced it would seek comments on a proposed rulemaking regarding Fannie Mae and Freddie Mac liquidity requirements.

FHFA Holds GSE Affordable Housing Goals Steady

The Federal Housing Finance Agency on Wednesday announced its 2021 affordable housing goals for Fannie Mae and Freddie Mac will remain the same as they were in 2020. It also seeks input about future housing goals rulemaking.

The Redesigned URLA Mandate Is Around the Corner. Will Your Technology Solution Be Ready?

December is always a busy month, and this is especially true for mortgage lenders this year. With 2021 rapidly approaching, the deadline to implement the redesigned URLA and updated automated underwriting system (AUS) datasets will be here before we know it.

FHFA: GSE Non-Performing Loan Portfolios Down 70%

The Federal Housing Finance Agency’s latest report on sale of non-performing loans by Fannie Mae and Freddie Mac showed of loans one or more years delinquent held in the Enterprises’ portfolios decreased by 70 percent.