FundingShield, Newport Beach, Calif., released its Q4 2025 fraud analytics report, finding that problematic loans exhibited an average of 3.2 issues per transaction–an all-time high.

Tag: Fraud

Federal Law Enforcement on What the Industry Needs to Know About Fraud Trends

WASHINGTON–“The bad guys are always finding new ways to reinvent themselves,” said Stavros Nikolakakos, the deputy special agent in charge of the Washington field office, United States Secret Service.

Most Compliance Professionals View Technology-Driven Risks as Top Threat, eflow Global Finds

Nearly two-thirds of regulatory compliance professionals say technology-driven risk is the most significant market force likely to cause compliance issues for financial services firms, according to eflow Global, Boston.

First American’s Sarah Frano on AI-Driven Fraud: The Hidden Threat in Real Estate

The tools and technologies powered by artificial intelligence continue to evolve rapidly, and while the real estate industry is harnessing AI to automate everything from property valuations and predictive analytics to customer relationship management and fraud prevention, scammers are harnessing AI to identify targets, rapidly scale their schemes and avoid detection.

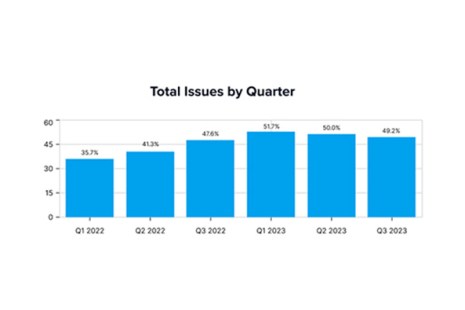

FundingShield: Fraud Risk Report Shows Slight Drop

FundingShield, Newport Beach, Calif., found that during the third quarter, 46.43% of transactions on an $82 billion portfolio of residential, commercial and business purpose loans had issues leading to a risk of wire and title fraud.

Fraud Panel: Watch Out for ‘Low-Hanging Fruit,’ Synthetic Identities, Business Email Compromises

WASHINGTON, D.C.–Experts took to the stage at the Mortgage Bankers Association’s Compliance and Risk Management Conference Sept. 23, to highlight the importance of being vigilant in all aspects of digital life and provide insights into fraud trends that could be seen by those working in the mortgage industry.

FundingShield: Fraud Risk Still High in Q2

FundingShield, Newport Beach, Calif., released its second-quarter report, finding that 47.08% of transactions in a $74 billion portfolio including residential, commercial and business purpose loans presented some risk.

RealPage Survey Reveals Multifamily Fraud Is on the Rise

RealPage, Richardson, Texas, found more than 75% of survey participants report an increase in rental fraud in their multifamily communities in the past year.

FundingShield: Concerns of Wire, Title Fraud Still High in Q3

FundingShield, Newport Beach, Calif., reported risks of wire and title fraud remained high in third-quarter data, although fairly flat from the previous quarter.

#MBARMQA22: Focusing on the Weakest Links

NASHVILLE, TENN.—The housing market today is nothing like 2008, said Christa Lynn Greco, IA with the Criminal Investigative Division of the Federal Bureau of Investigation, Washington, D.C. But she said changing market conditions make the potential for mortgage fraud ever-present.