Zillow, Seattle, said its analysis found more than $1.7 billion in rent and mortgage payments is owed each month by U.S. service-sector workers currently receiving unemployment benefits as a result of the coronavirus pandemic — payments that could be in jeopardy if expanded local and federal unemployment assistance fades or workers remain without incomes longer than expected.

Tag: Forbearance

Black Knight: 1 in 10 Homeowners in Forbearance Hold 10% or Less Equity in Their Homes

Black Knight, Jacksonville, Fla., said with its analysis of borrowers in forbearance showing forbearance volumes falling for the first time since the crisis began, industry participants – especially servicers and mortgage investors – must now shift from pipeline growth to pipeline management and downstream performance of loans in forbearance.

FHA, CFPB Issue New Guidance on Forbearance

The Federal Housing Administration and the Consumer Financial Protection Bureau announced new policies to assist mortgage borrowers impacted by the economic effects of the coronavirus pandemic.

Tom Lamalfa: May 2020 Survey of Secondary Market Executives

What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancellation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.

MBA Mortgage Action Alliance ‘Call to Action’ Urges Support of House Bill Supporting Access to Credit

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a “Call to Action” urging its members to contact their House representative in support of legislation that would promote consumer access to credit during the coronavirus pandemic.

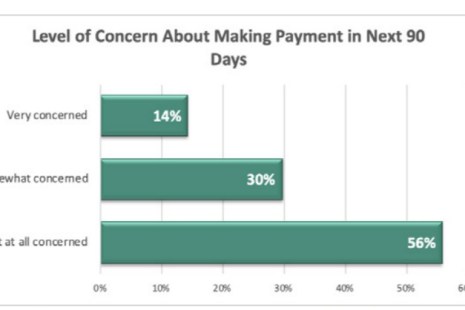

STRATMOR Study Lays Bare Uncertainties of COVID-19 Impact on Housing Market

A study by STRATMOR Group, Greenwood Village, Colo., shows just how quickly and hard-hitting the coronavirus pandemic has been on homeowners.

FHFA Announces Refi/Home Purchase Eligibility for GSE Borrowers in Forbearance

Fannie Mae and Freddie Mac issued temporary guidance May 19 regarding the eligibility of borrowers who are in forbearance, or have recently ended their forbearance, looking to refinance or buy a new home.

House Passes $3 Trillion COVID-19 Relief Package; MBA Letter Details Industry Priorities

The House on Friday passed a massive $3 trillion pandemic relief bill on Friday that includes several key housing provisions advocated by the Mortgage Bankers Association.

MBA Outlines Industry Priorities for Next COVID-19 Relief Package

The House has its wish-list for the next round of relief stemming from the coronavirus pandemic—a $3 trillion package that has no chance of passing into law. The Senate is working on its own version—which also has no chance of passing. To help Congress out, the Mortgage Bankers Association provided House and Senate leadership with its legislative priorities for the next relief package.

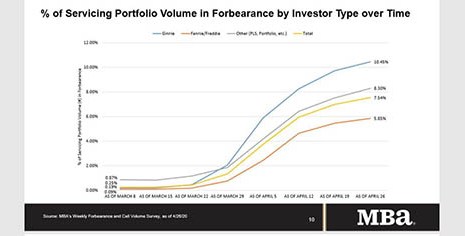

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, 3.8 million homeowners are now in forbearance plans.