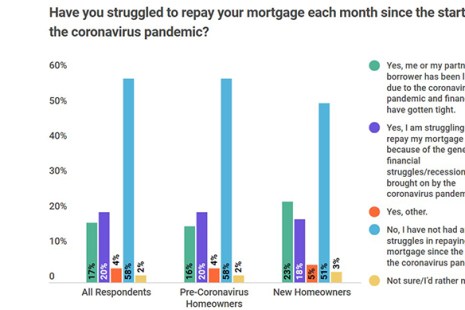

A new survey from LendEDU, Hoboken, N.J., finds more than half of new homeowners regret taking out a mortgage during the coronavirus pandemic, with most of them citing a job layoff as the reason for their angst.

Tag: Forbearance

FHFA Extends GSE Forbearance Purchases through Sept. 30; Extends COVID-Related Loan Processing Flexibilities

The Federal Housing Finance Agency announced Wednesday that Fannie Mae and Freddie Mac will extend buying qualified loans in forbearance and several loan origination flexibilities through September 30.

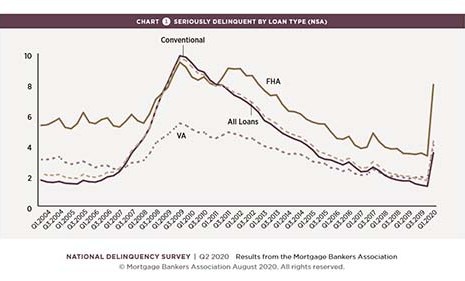

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

FHFA Extends Temporary Policy Allowing Purchase of Qualified Loans in Forbearance to Aug. 31

The Federal Housing Finance Agency approved an extension of the temporary policy that allows for the purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria set by Fannie Mae and Freddie Mac. The policy is extended for loans originated through August 31.

FHFA: Multifamily Owners in Forbearance Must Inform Tenants of Eviction Suspension, Tenant Protections

The Federal Housing Finance Agency announced Thursday multifamily property owners with mortgages backed by Fannie Mae or Freddie Mac who enter into a forbearance agreement must inform their tenants about protections during the property owner’s forbearance and repayment periods.

Fitch: Borrowers Skipping Payments on Home Loans More Often Than Other Debt

Residential mortgage borrowers are missing more payments and taking advantage of payment holiday programs at a higher rate than comparable-credit borrowers of auto loans and credit cards, said Fitch Ratings New York.

Maurice Jourdain-Earl of ComplianceTech on CARES Act Relief and Racial Disparities in Mortgage Forbearance

MBA NewsLink talked with Maurice Jourdain-Earl, Managing Director of ComplianceTech, McLean, Va., a provider of software and services to enable fair and responsible lending compliance. He is a noted speaker and writer on HMDA and fair lending practices and has appeared frequently at MBA events and sits on MBA’s member-led Diversity & Inclusion Advisory Committee.

Anita Bush: Offering Forbearance Under the CARES Act – A New Reality for Mortgage Servicers

While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

Fitch Ratings: CRE Defaults Likely To Rise After Forbearance Periods

Fitch Ratings, New York, said it anticipates commercial real estate loan defaults will rise at the end of forbearance periods.