MBA President and CEO Bob Broeksmit, CMB, issued a statement on the Federal Housing Finance Agency’s 2026-2028 Enterprise Housing Goals final rule for Fannie Mae and Freddie Mac.

Tag: FHFA

FHFA Increases Conforming Loan Limit Values for 2026

Last Tuesday, U.S. Federal Housing increased the conforming loan limit values for mortgages Fannie Mae and Freddie Mac will acquire in 2026. In most of the United States, the 2026 CLL value for one-unit properties will be $832,750, up $26,250 from 2025.

Bill Pulte on What’s Next for Federal Housing, Conservatorship and Transparency

NEW YORK–“I think federal housing has been underrepresented,” said Federal Housing Finance Agency Director Bill Pulte. “I think this room has been underrepresented historically at the federal level.”

MBA Statement on FHFA Order Rescinding Regulated Entity UDAP Compliance

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the Federal Housing Finance Agency’s (FHFA) order that rescinds Advisory Bulletin 2024:06: Regulated Entity Unfair or Deceptive Acts or Practices (UDAP) Compliance.

MBA Statement on the Confirmation of William Pulte as FHFA Director

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on William Pulte’s confirmation by the full Senate to serve as Director of the Federal Housing Finance Agency (FHFA):.

MBA Statement on FHFA and Treasury Amendments to the Preferred Stock Purchase Agreements

MBA’s President and CEO Bob Broeksmit, CMB, issued a statement on the Jan. 2 Federal Housing Finance Agency (FHFA) and U.S. Treasury amendments to the Preferred Stock Purchase Agreements (PSPAs).

MBA Statement on FHFA Updates on Loan Repurchases, Appraisals, and Pricing

DENVER–MBA President and CEO Bob Broeksmit, CMB, issued the following statement on the Federal Housing Finance Agency (FHFA) announcements on loan repurchases, appraisals, and pricing at MBA’s 2024 Annual Convention and Expo:

FHFA Announces Updates on Repurchases, Appraisals, Pricing at Annual24

DENVER–The Federal Housing Finance Agency’s Naa Awaa Tagoe, Deputy Director, Division of Housing Mission and Goals, announced a series of updates at the Mortgage Bankers Association Annual Conference & Expo Oct. 28.

MBA Statement on FHFA’s Suspended Counterparty Program Re-Proposal

MBA President and CEO Bob Broeksmit, CMB, issued a statement regarding the Federal Housing Finance Agency’s announced re-proposal of amendments to its Suspended Counterparty Program (SCP) regulation.

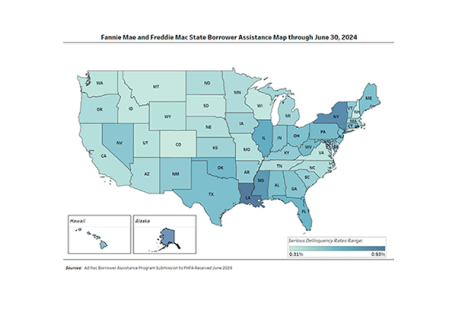

FHFA Reports More Than 7 Million Foreclosure Prevention Actions During GSE Conservatorships

The Federal Housing Finance Agency reported that Fannie Mae and Freddie Mac completed 46,378 foreclosure prevention actions during the second quarter, raising the total number of homeowners who have been helped to 7,004,262 since the start of conservatorships in September 2008.