MBA President and CEO Bob Broeksmit, CMB, released a statement on President Donald Trump’s announcement of his intention to nominate Kevin Warsh to serve as Chairman of the Federal Reserve.

Tag: Federal Reserve

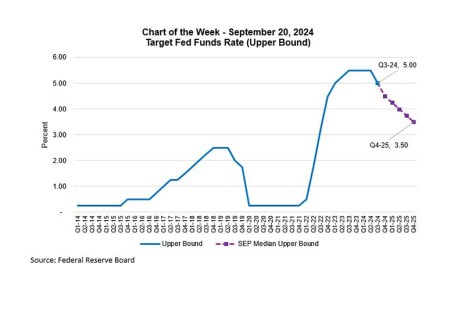

Chart of the Week: FOMC Summary of Economic Projections for Fed Funds Rate

Each quarter, members of the Federal Open Market Committee (FOMC) submit their projections for various economic measures (i.e., real gross domestic product growth, the unemployment rate, inflation, and the federal funds rate). This month’s projections, shown in the Summary of Economic Projections (SEP), include 2028 for the first time.

N.Y. Fed President John Williams Offers Economic Outlook

NEW YORK–John Williams, President and CEO of the Federal Reserve Bank of New York, offered an optimistic but measured view of the U.S. economy during a session at the Mortgage Bankers Association’s Secondary and Capital Markets Conference.

FOMC Rate Pause Remains; MBA Economist Weighs In

The Federal Reserve’s Federal Open Market Committee left interest rates unchanged on Wednesday.

Vaultedge’s Murali Tirupati–Fed’s Rate Cuts Signal Growth: Positive Outlook for Mortgage Lending in 2025

The Federal Reserve’s recent decision to reduce rates by 50 basis points, with further cuts expected through 2025, offers a key turning point for the mortgage industry.

MBA Chart of the Week: Target Fed Funds Rate

The FOMC lowered the target Fed Funds rate by 50 basis points at its September meeting and signaled that this is the first cut in a series that is expected to bring the Fed Funds rate down by about 2 percentage points by the end of 2025.

Fed Cuts Interest Rates 50 Basis Points; MBA Economist Weighs In

The Federal Reserve cut interest rates by 50 basis points Sept. 18.

MBA Economist Mike Fratantoni on Jerome Powell’s Remarks Indicating Cuts

Federal Reserve Chair Jerome Powell spoke Aug. 23 at an economic symposium sponsored by the Federal Reserve Bank of Kansas City, in Jackson Hole, Wyo. His remarks implied the likelihood of near-term rate cuts.

Fed Holds Rates Steady Again

The Federal Reserve again held rates steady July 31, noting that there has been “some further progress toward the Committee’s 2% inflation objective” over the past few months.

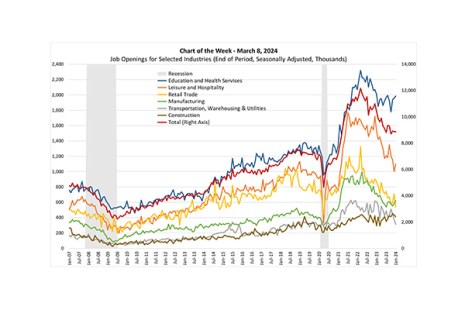

MBA Chart of the Week: Job Openings for Selected Industries

Last week Fed Chair Jay Powell testified to Congress that as “labor market tightness has eased and progress on inflation has continued, the risks to achieving our employment and inflation goals have been moving into better balance.”