The Federal Housing Finance Agency announced that Fannie Mae and Freddie Mac will eliminate the 50 basis point “Adverse Market Refinance Fee” for loan deliveries effective August 1.

Tag: Federal Housing Finance Agency

MBA Asks FHFA for Clarity on GSE Short-Term Rental Policies

The Mortgage Bankers Association, in a July 6 letter to the Federal Housing Finance Agency, asked FHFA for more definitive guidance on the government-sponsored enterprises’ policies on mortgages for properties that include short-term rental units.

Supreme Court Rules FHFA Director ‘Removable at Will;’ Calabria Out

The Supreme Court on Wednesday ruled that the structure of the Federal Housing Finance Agency is unconstitutional, allowing the President to remove its director at will. Shortly after the ruling, The Biden Administration removed Mark Calabria as FHFA Director.

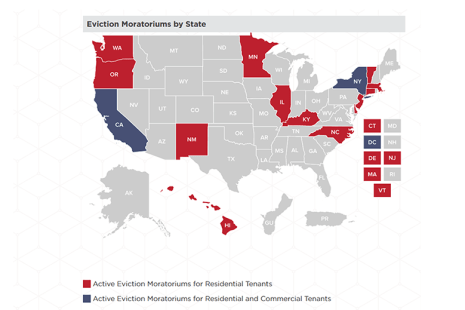

CDC Extends National Residential Eviction Moratorium for Final Time to July 31

The Centers for Disease Control and Prevention on Thursday extended its nationwide residential eviction moratorium by another month, to July 31.

White House Names Sandra L. Thompson Acting FHFA Director

The White House appointed Sandra L. Thompson as Acting Director of the Federal Housing Finance Agency effective immediately.

FHFA, GSEs Extend COVID-19 Multifamily Forbearance through Sept. 30

The Federal Housing Finance Agency on Thursday said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through September 30

FHFA Announces GSEs’ Proposed Duty to Serve Underserved Markets Plans for 2022-2024

The Federal Housing Finance Agency published proposed 2022-2024 Underserved Markets Plans submitted by Fannie Mae and Freddie Mac under the Duty to Serve program. The proposed Plans cover the period from January 1, 2022 to December 31, 2024.

FHFA Publishes Final Rule on GSE ‘Living Wills’

The Federal Housing Finance Agency on Monday published a final rule that requires Fannie Mae and Freddie Mac to develop credible resolution plans, also known as “living wills.”

FHFA Announces New Refi Option for Low-Income Borrowers with GSE-Backed Mortgages

The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will implement a new refinance option for low-income borrowers with government-sponsored enterprise-backed single-family mortgages.

#MBASpring21: Administration Acknowledges Issues with GSE Product Caps

During the final months of the Trump Administration, the Federal Housing Finance Agency implemented product caps on Fannie Mae and Freddie Mac through their Senior Preferred Stock Purchase Agreements—a move that the Mortgage Bankers Association called “disruptive” for many of its members.