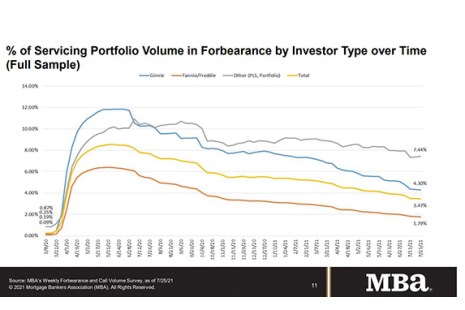

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

Tag: Fannie Mae

MBA MAA ‘Call to Action’ on GSE ‘G-Fees’

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ on Monday to its 70,000-plus members urging them to tell their elected officials to not use government-sponsored enterprise guaranty fees (g-fees) as a source of funding offsets.

MBA, Trade Groups Reiterate Opposition to G-Fee Offsets

Fresh off of last week’s regulatory victory in which the Federal Housing Finance Agency withdrew its controversial adverse market refinance fee, the Mortgage Bankers Association and several dozen industry trade groups took fresh aim at another controversial practice—a move in Congress to use the government-sponsored enterprises’ guaranty fees—known as “g-fees”—to offset funding for non-housing programs.

MBA Asks FHFA for Clarity on GSE Short-Term Rental Policies

The Mortgage Bankers Association, in a July 6 letter to the Federal Housing Finance Agency, asked FHFA for more definitive guidance on the government-sponsored enterprises’ policies on mortgages for properties that include short-term rental units.

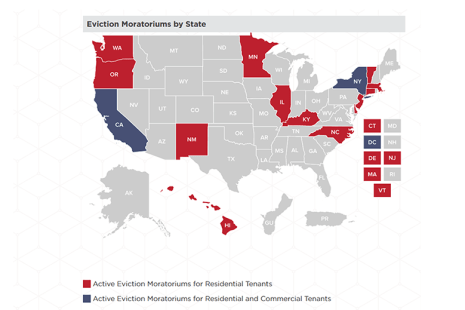

CDC Extends National Residential Eviction Moratorium for Final Time to July 31

The Centers for Disease Control and Prevention on Thursday extended its nationwide residential eviction moratorium by another month, to July 31.

FHFA, GSEs Extend COVID-19 Multifamily Forbearance through Sept. 30

The Federal Housing Finance Agency on Thursday said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through September 30

FHFA Announces GSEs’ Proposed Duty to Serve Underserved Markets Plans for 2022-2024

The Federal Housing Finance Agency published proposed 2022-2024 Underserved Markets Plans submitted by Fannie Mae and Freddie Mac under the Duty to Serve program. The proposed Plans cover the period from January 1, 2022 to December 31, 2024.

#MBANAC21: Senators Outline Housing Priorities

Three members of the Senate Banking Committee visited the Mortgage Bankers Association’s National Advocacy Conference to talk about renewed interest in housing priorities in the 117th Congress.

FHFA Publishes Final Rule on GSE ‘Living Wills’

The Federal Housing Finance Agency on Monday published a final rule that requires Fannie Mae and Freddie Mac to develop credible resolution plans, also known as “living wills.”

FHFA Announces New Refi Option for Low-Income Borrowers with GSE-Backed Mortgages

The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will implement a new refinance option for low-income borrowers with government-sponsored enterprise-backed single-family mortgages.