The Mortgage Bankers Association, in a letter last week to the Federal Housing Finance Agency, said the Agency should not inadvertently hinder innovation through choices made by its regulated entities.

Tag: Fannie Mae

MBA Commends FHFA’s New Enterprise Housing Goals Methodology Proposal

The Mortgage Bankers Association on Thursday commended the Federal Housing Finance Agency for its proposed rule establishing 2023-2024 Multifamily Enterprise Housing Goals for Fannie Mae and Freddie Mac.

FHFA: GSEs Complete 97,000 2nd Quarter Foreclosure Preventions

The Federal Housing Finance Agency released its second quarter Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 96,945 foreclosure prevention actions during the quarter, raising the total number of homeowners who have been helped to 6,591,002 since start of conservatorships in September 2008.

FHFA, Ginnie Mae Update Capital, Liquidity, Net Worth Requirements for Seller/Servicers, Issuers

The Federal Housing Finance Agency and Ginnie Mae on Wednesday updated minimum financial eligibility requirements for seller/servicers and issuers.

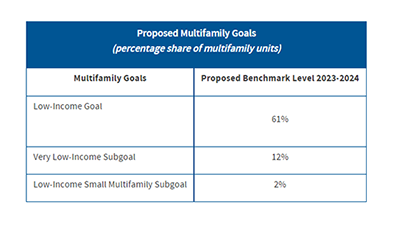

FHFA Proposes 2023-2024 Fannie Mae, Freddie Mac Multifamily Housing Goals

The Federal Housing Finance Agency on Tuesday proposed new benchmark levels for Fannie Mae and Freddie Mac multifamily housing goals in 2023 and 2024.

FHFA Announces Update for Services to Maintain Fair Lending Data

The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will require servicers to obtain and maintain fair lending data on their loans, and for this data to transfer with servicing throughout the mortgage term.

FHFA: Fannie, Freddie NPL Sales at 155,000

Fannie Mae and Freddie Mac have sold nearly 155,000 non-performing loans with a total unpaid principal balance of $28.7 billion since 2014, the Federal Housing Finance Agency reported.

Broeksmit Weighs in on How to Narrow Minority Homeownership Gap

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, said Special Purpose Credit Programs can provide lenders with an effective way to serve minority groups who do not have access to generational wealth.

Fitch: FHFA Final Capital Rules Supportive of Credit for Fannie, Freddie

Fitch Ratings, New York, said the Federal Housing Finance Agency recent adoption of final regulations requiring the submission of annual capital plans and new public risk disclosures for Fannie Mae and Freddie Mac are creditor positive.

FHFA, GSEs Detail Equitable Housing Finance Plans

The Federal Housing Finance Agency on Wednesday offered details of the government-sponsored enterprises’ Equitable Housing Finance Plans for 2022-2024.