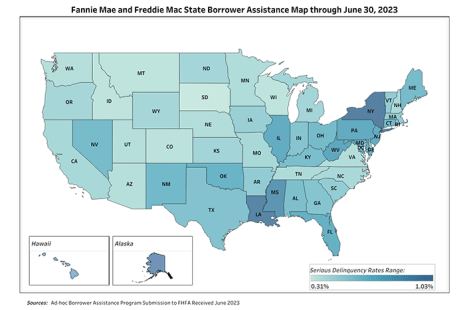

The Federal Housing Finance Agency reported Fannie Mae and Freddie Mac completed 43,356 foreclosure prevention actions during the third quarter, raising the total number of homeowners who have been helped to 6.86 million since the start of conservatorships in 2008.

Tag: Fannie Mae

Fannie Mae: Mortgage Lenders Cite Operational Efficiency as Primary AI Motivation

Mortgage lenders overwhelmingly cited improving operational efficiency as their primary motivation for adopting Artificial Intelligence/Machine Learning, reported Fannie Mae, Washington, D.C.

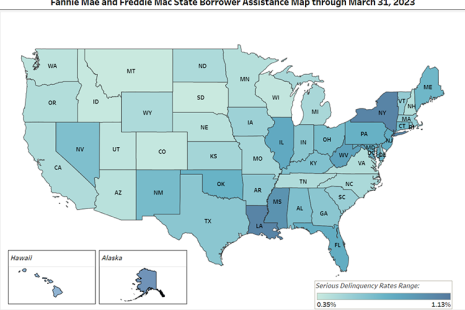

FHFA: GSEs Completed 47,370 Foreclosure Prevention Actions During Second Quarter

Fannie Mae and Freddie Mac completed 47,370 foreclosure prevention actions during the second quarter, raising the total number of homeowners helped to 6.8 million since the conservatorships started in 2008, the Federal Housing Finance Agency reported.

LoanLogics’ Jenevieve Impavido: Overcoming a New Catch-22—Fannie Mae’s QC Requirements

It’s been one of the hottest summers ever in the U.S.—in fact, according to NASA, July 2023 was the warmest month in recorded history. Likewise, the mortgage industry has started feeling heat of its own with new, more stringent Fannie Mae guidelines for QC reviews and rising GSE repurchase activity.

FHFA: More Than 6.7M Troubled Homeowners Helped During Conservatorships

Fannie Mae and Freddie Mac completed 58,268 foreclosure prevention actions in the first quarter, the Federal Housing Finance Agency reported Friday.

FHFA Issues Notice of Proposed Rulemaking on Fair Lending Oversight

The Federal Housing Finance Agency seeks comment on a proposed rule that would formalize many existing practices regarding fair housing and fair lending oversight of Fannie Mae, Freddie Mac and the Federal Home Loan Banks.

FHFA Announces Process for Implementing New Credit Score Requirements; MBA Encourages Members to Complete Survey

The Federal Housing Finance Agency recently requested stakeholder input as Fannie Mae and Freddie Mac replace the Classic FICO credit score model with the FICO 10T and the VantageScore 4.0 credit score models, and transition from requiring three credit reports to requiring two credit reports for single-family loan acquisitions.

Sharon Reichhardt of ACES Quality Management: Spring Your QC Forward or Fall Behind Fannie Mae’s New Requirements this September

Given the downturn in mortgage volume and the exploding cost to originate, Fannie Mae’s announcement comes at a time when QC departments may be much leaner than they were the year before. However, lenders can ill afford to ignore these changes, and compliance may mean investing in automation despite declining profitability.

FHFA Updates Equitable Housing Finance Plans for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency updated Fannie Mae and Freddie Mac’s Equitable Housing Finance Plans for 2023.

Fannie Mae, Freddie Mac Complete 52,469 4Q Foreclosure Prevention Actions

Fannie Mae and Freddie Mac completed 52,469 foreclosure prevention actions during the fourth quarter, raising the total number of homeowners who have been helped to 6.7 million since September 2008, the Federal Housing Finance Agency reported.