Fannie Mae, Washington, D.C., and Freddie Mac, McLean, Va., announced yesterday they will issue requests for proposals to hire an underwriting financial advisor to assist in developing and implementing a plan for recapitalizing and “responsibly ending” their conservatorship.

Tag: Fannie Mae

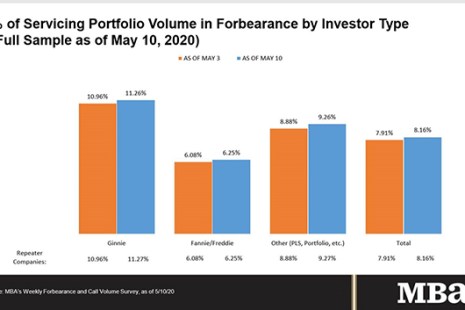

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

FHFA, FHA Extend Foreclosure/Eviction Moratorium to June 30

The Federal Housing Finance Agency and FHA said Thursday they would extend moratoria for Fannie Mae-, Freddie Mac- and FHA-based single-family mortgages until at least June 30.

FHFA, GSEs Offer Payment Deferral as Repayment Option for COVID-19 Forbearance Plans

The Federal Housing Finance Agency on Wednesday said Fannie Mae and Freddie Mac will employ a new payment deferral option allowing borrowers in COVID-19 related forbearance, who are able to return to making their normal monthly mortgage payment, the ability to repay their missed payments at the time the home is sold, refinanced, or at maturity.

FHFA Extends Loan Processing Flexibilities for GSE Customers; Offers Tools for Renter Protection

The Federal Housing Finance Agency extended several loan origination flexibilities currently offered by Fannie Mae and Freddie Mac designed to help borrowers during the COVID-19 pandemic.

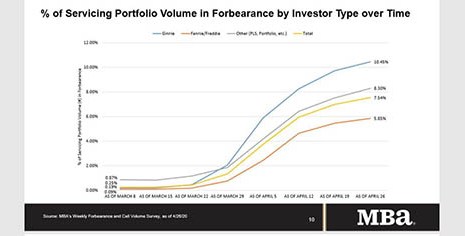

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, 3.8 million homeowners are now in forbearance plans.

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

While the hope remains that the recession will be short-lived with a strong recovery in the second half of 2020, commercial real estate typically lags the broader economy. Any quick relief for the commercial mortgage industry will be due in part to government relief efforts. It will take patience from market participants before a clear picture of various outcomes emerges, in part because so much of the CRE finance market impacted by COVID-19 is entering into forbearance agreements.

GSEs: No Lump Sum Required at End of Forbearance

he Federal Housing Finance Agency, Fannie Mae and Freddie Mac issued announcements yesterday reiterating borrowers in forbearance with a Fannie Mae or Freddie Mac-backed mortgage are not required to repay the missed payments in one lump sum.

FHFA: GSEs Will Purchase Qualified Loans in Forbearance

The Federal Housing Finance Agency said it would approve purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria by Fannie Mae and Freddie Mac.

FHFA: Fannie Mae, Freddie Mac to Use 4-Month Advance Limit for Loans in Forbearance

The Federal Housing Finance Agency last week said it aligned Fannie Mae and Freddie Mac policies regarding servicer obligations to advance scheduled monthly principal and interest payments for single-family mortgage loans.