The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

Tag: Fannie Mae

MBA: Share of Loans in Forbearance Drops for 4th Straight Week

MBA Forbearance Survey lede sentence HERE

FHFA Extends GSE Loan Processing Flexibilities Through Aug. 31

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will extend several loan origination flexibilities until August 31 to ensure continued support for borrowers during the COVID-19 national emergency.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

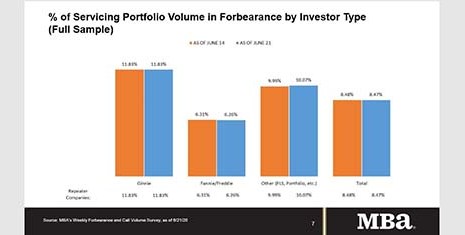

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

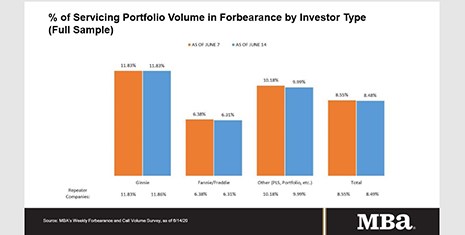

MBA: Share of Mortgage Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

FHFA, FHA Extend Foreclosure/Eviction Moratorium to Aug. 31

The Federal Housing Finance Agency and HUD announced Fannie Mae, Freddie Mac and FHA will extend their single-family moratorium on foreclosures and evictions until at least August 31.

MBA: 1QCommercial, Multifamily Mortgage Delinquencies Remain Low

Commercial and multifamily mortgage delinquencies remained low at the end of the first quarter, the Mortgage Bankers Association said in its first quarter Commercial/Multifamily Delinquency Report.

FHFA to Re-Propose Updated Minimum Financial Eligibility Requirements for GSE Sellers/Servicers

The Federal Housing Finance Agency, citing “recent market events,” announced it will re-propose updated minimum financial eligibility requirements for Fannie Mae and Freddie Mac Seller/Servicers.

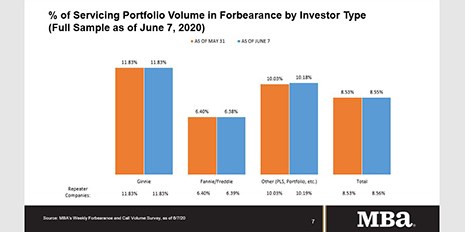

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.