Cotality, Irvine, Calif., released its Homeowner Equity Report for Q2, reporting that the average U.S. homeowner lost approximately $9,200 in equity over the past year.

Tag: Equity

Transunion: Total Tappable Home Equity Remains High

Transunion, Chicago, released its Q2 Home Equity Report, finding that total tappable home equity stands at $21.5 trillion, up 5% year-over-year.

ATTOM: Home Equity Dips Slightly in Q1

ATTOM, Irvine, Calif., released its Q1 Home Equity and Underwater Report, revealing that 46.2% of mortgaged residential properties were considered equity-rich in the first quarter.

Redfin: Combined Value of U.S. Homes Climbed to $49.7 Trillion

Redfin, Seattle, reported the combined value of U.S. homes increased $2.5 trillion in 2024 to hit $49.7 trillion.

ATTOM: Home Equity Steady in Q4

ATTOM, Irvine, Calif., released its Q4 2024 U.S. Home Equity and Underwater Report, showing that 47.7% of mortgaged residential properties could be deemed equity-rich in the quarter.

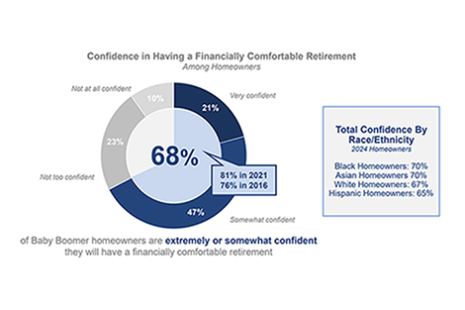

Freddie Mac Finds Boomers Hold $17 Trillion of Country’s Total Home Equity

Three-quarters of homeowners born before 1964 are likely to leave much of their $17 trillion in home equity to their children, according to Freddie Mac’s latest analysis of Baby Boomers’ housing perceptions, preferences and plans.

CoreLogic: National Homeowner Equity Up 2.5% in Q3

CoreLogic, Irvine, Calif., found that U.S. homeowners with mortgages saw equity increase by $425 billion since Q3 2023—a gain of 2.5% year-over-year.

ICE: Record Levels of Tappable Equity in Q3

Intercontinental Exchange Inc., Atlanta, reported that mortgage holders at the end of the third quarter held $17.2 trillion in equity. Of that, $11.2 trillion was deemed tappable–meaning it can be borrowed against with the homeowner still maintaining a 20% equity stake.

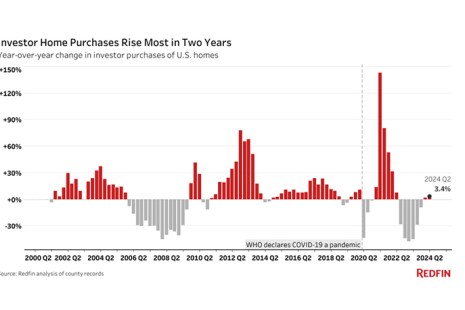

Redfin: Investor Home Purchases Post Biggest Increase Since Q2 2022

Investor purchases of homes were up 3.4% year-over-year in Q2, per Redfin, Seattle.

Dovenmuehle’s Anna Krogh: When Unlocking the Potential of Home Equity, Understanding the Servicing Nuances is Key

Home Equity Lines of Credit (HELOCs) provide a flexible borrowing option for homeowners looking to access their home equity, offering an alternative to traditional cash-out refinances, which homeowners may be reluctant to consider if they’re currently holding a below-market interest rate on their primary mortgage.