LendingTree, Charlotte, N.C., released an analysis on current down payment trends, finding that the median planned down payment has increased sharply since 2021. Planned down payments now account for larger shares of loan amounts and borrowers’ incomes, too.

Tag: Down Payment

AD Mortgage Examines Homeownership Down Payment Timelines

The time it takes for typical household to save for a down payment varies widely across the U.S., AD Mortgage, Fort Lauderdale, Fla., found in a new report.

Down Payment Resource: Another Record-Setting Quarter for Homebuyer Assistance

Down Payment Resource, Atlanta, released its Q3 Homeownership Program Index, finding 70 new assistance programs were added during the period.

Redfin: Almost One-Quarter of Young Buyers Used Gift or Inheritance in Down Payment

Redfin, Seattle, released a new study finding that 23.8% of Gen Z or millennials who recently bought a home used some form of family money to help fund their down payment.

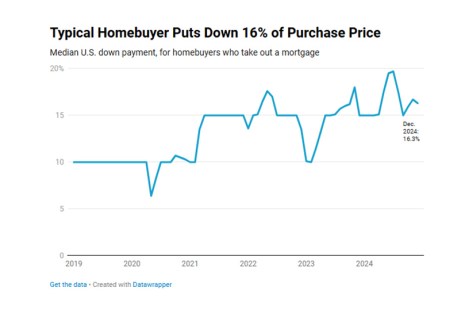

Redfin: Typical Buyer Putting Up 16.3% Down Payment

Redfin, Seattle, reported that the typical U.S. homebuyer’s down payment in December was 16.3% of the purchase price, up from 15% a year earlier.

Redfin Reports Typical Down Payment Hits Record $67,500

The typical down payment for U.S. homebuyers hit a record $67,500 in June, up nearly 15% from $58,788 a year earlier, according to a new report from Redfin, Seattle.

Zillow: Middle-Class Americans Must Put Down More Than $127,000 to Afford Monthly Mortgage

A new Zillow analysis shows that to comfortably afford a typical U.S. home, a median-income homebuyer needs to put down nearly $127,750, or 35.4%.

21 Years to Save for a Down Payment, Survey Finds

U.S. Mortgage Insurers, an association representing private mortgage insurance companies, said its annual state-by-state report on low down payment mortgage lending found saving for a 20 percent down payment could take potential homebuyers 21 years — three times the length of time it could take to save a 5 percent down payment.