Redfin, Seattle, released a new study finding that 33.5% of Baby Boomers who currently own their homes say they’ll “never sell.”

Tag: Daryl Fairweather

Quote Tuesday, July 25, 2023

“The consequences of climate change haven’t fully sunk in for many Americans because oftentimes, homeowners and renters don’t foot the whole bill when disaster strikes. Insurers and government programs frequently subsidize the cost of rebuilding after storms hit, and mortgages mean homeowners are ceding some risk to lenders—especially if their house goes into foreclosure after a storm.”

–Redfin Chief Economist Daryl Fairweather

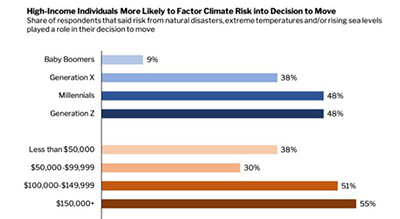

Homebuyers, Sellers Shift on Climate Risk Issues

Earlier this year, you could get a bidding war for swampland in Florida. Now, said Redfin, Seattle, homebuyers and sellers are getting pickier—and particularly when it comes to climate risk.

More Homebuyers Flock to Climate Risky Areas, Despite Intensifying Natural Disasters

Wildfires? Floods? Other natural disasters? “Bring it on,” homeowners seem to be saying.

Homebuyers on $2,500 Monthly Budget Lose $118,000 in Spending Power in 2022

Redfin, Seattle, said a homebuyer on a $2,500 monthly budget has lost nearly $120,000 in spending power since the end of last year as mortgage rates have nearly doubled.

Typical Buyer’s Monthly Payment Up Nearly 40%

Redfin, Seattle, reported the typical homebuyer’s monthly mortgage payment shot up 39%, the largest year-over-year gain on record, as the average 30-year-fixed rate hovered at 5.1%.

Typical Buyer’s Monthly Payment Up Nearly 40%

Redfin, Seattle, reported the typical homebuyer’s monthly mortgage payment shot up 39%, the largest year-over-year gain on record, as the average 30-year-fixed rate hovered at 5.1%.

Homeowner Tenure Flattens After 10-Year Rise

The typical American homeowner in 2021 had spent 13.2 years in their home, down slightly from the peak of 13.5 years in 2020 but up significantly from 10.1 years in 2012, said Redfin, Seattle.

One-Third of Millennial Homebuyers Using Extra Savings from Pandemic for Down Payment

For nearly one-third (31%) of millennial first-time homebuyers, the ability to save extra money during the coronavirus pandemic helped them accumulate the money needed for a down payment, said Redfin, Seattle.

Despite Home-Equity Uptick, Black American Median Home Values Lag Behind

Despite promising data showing substantial gains in home equity, Black Americans still lag well behind other demographic cohorts, according to a new report from Redfin, Seattle.