Hurricane seasons and climate change are threatening to redraw coastal U.S. maps. But it’s not stopping homebuyers from chasing down waterfront properties.

Tag: CoreLogic

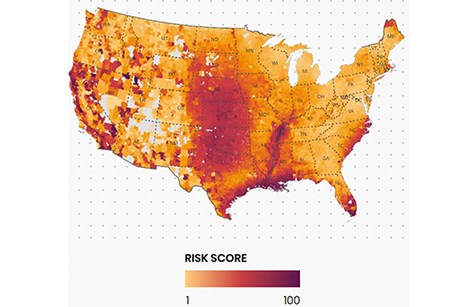

As Hurricane Season Starts, 31 Million Homes ID’d as ‘High-Risk’

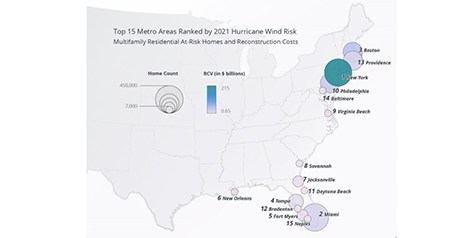

June 1 marked the start of the 2021 hurricane season. The National Oceanic and Atmospheric Administration projected another “above-normal” season, with as many as 20 named storms, 6-10 hurricanes and 3-5 major hurricanes (Category 3 or higher).

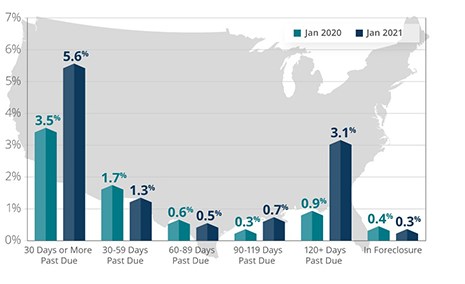

CoreLogic: Mortgage Delinquency Rates Level Off in February

Despite a small uptick in overall delinquencies, serious delinquencies continued to decrease, CoreLogic, Irvine, Calif., reported this morning.

2020 Mortgage Delinquencies See Record Highs—and Record Lows

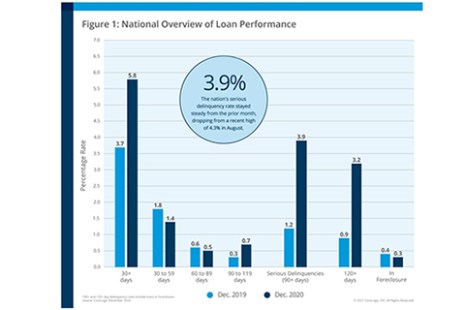

CoreLogic, Irvine, Calif., said its year-end Loan Performance Insights Report showed overall mortgage delinquency rates fell for the fourth straight month in December, ending a volatile year with signs of recovery.

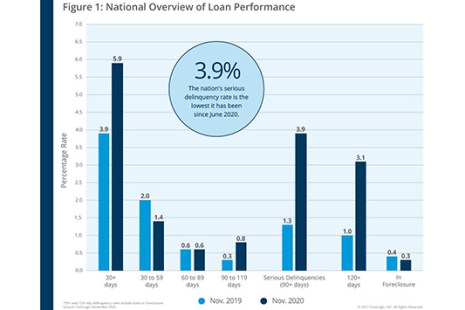

CoreLogic: November Mortgage Delinquency Rates at 11-Month Low

CoreLogic, Irvine, Calif., said new November mortgage delinquencies fell below pre-pandemic levels and, while serious delinquencies fell to their lowest levels since June.

CoreLogic: Catastrophes Illustrate Impact of Climate Change on Housing

When you include the word “catastrophe” in the headline of a report, it tends to get attention. And CoreLogic, Irvine, Calif., says “catastrophe” plays an ominous role in the present and future housing environments.

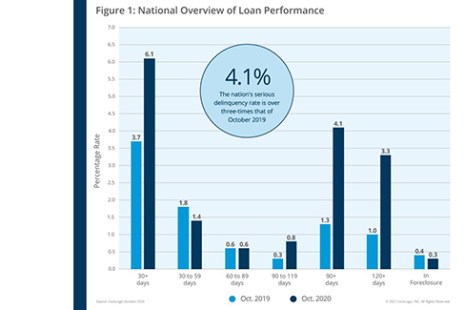

CoreLogic: Mortgage Delinquencies Rise, But Pace Moderates

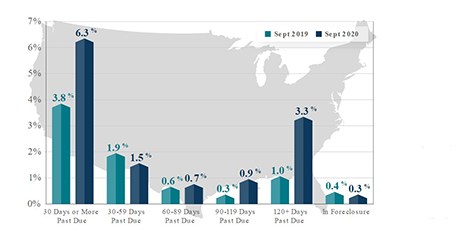

CoreLogic, Irvine, Calif., said on a national level, 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in October, a 2.4-percentage point increase from a year ago, when it was 3.7%.

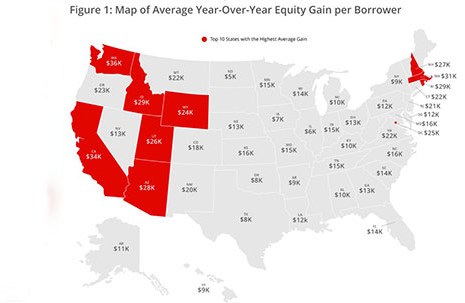

Home Equity Reaches Record High: Homeowners Gained $1 Trillion in 3Q Equity

CoreLogic, Irvine, Calif., said U.S. homeowners with mortgages saw their equity increase by 10.8% year over year in the third quarter—a collective equity gain of $1 trillion and an average gain of $17,000 per homeowner.

CoreLogic: Serious Delinquencies Level Off in ‘Positive Signal’

CoreLogic, Irvine, Calif., said its monthly Loan Performance Insights Report for September showed a leveling off of serious loan delinquencies, a “positive signal” that the housing finance industry is thus far adjusting to the pandemic-induced economic downturn.

CoreLogic: Foreclosures Remain Low; Serious Delinquencies Continue to Build Up

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.