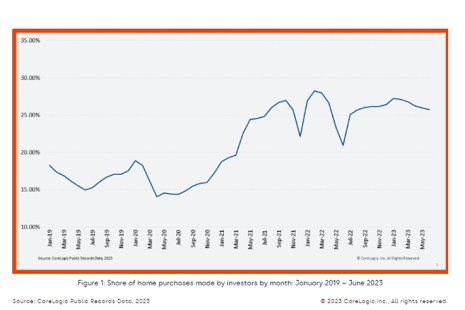

CoreLogic, Irvine, Calif., reported the U.S. home investor share remained high throughout the early summer, with 26% of all single-family home purchases in June.

Tag: CoreLogic

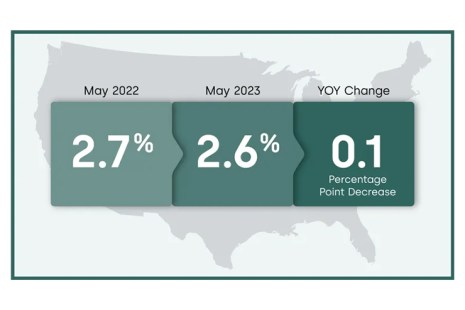

CoreLogic: Mortgage Delinquency Rate at Record Low in May

CoreLogic, Irvine, Calif., reported in May just 2.6% of all mortgages in the U.S. were in some stage of delinquency, matching the all-time low.

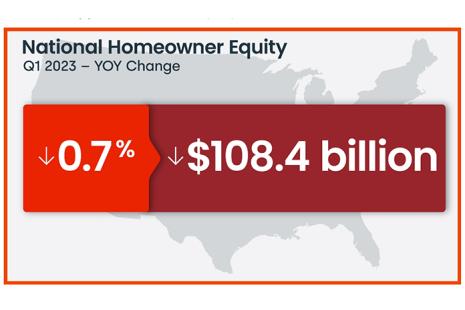

CoreLogic Reports Borrowers See First Annual Home Equity Losses Since 2012

U.S. homeowners with mortgages saw their home equity decrease by 0.7% year-over-year–an average loss of $5,400 per borrower–according to CoreLogic, Irvine, Calif.

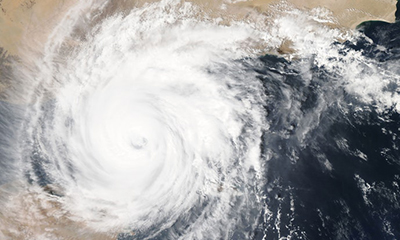

CoreLogic Says 33M Homes at Risk in 2023 Hurricane Season

CoreLogic, Irvine, Calif., reported 33 million U.S. properties are at risk of hurricane-force wind damage, with reconstruction cost value of $11.6 trillion, as the 2023 hurricane season kicks off.

CoreLogic: 20M Houses at High Risk from Severe Convective Storms

Twenty million single-family homes are at high risk from severe convective storms, reported CoreLogic, Irvine, Calif.

Mortgage Performance Remains ‘Exceptionally Healthy’

Reports from CoreLogic, Irvine, Calif., and Black Knight, Jacksonville, Fla., as well as last Monday’s Loan Monitoring Report from the Mortgage Bankers Association, show mortgage performance in the post-pandemic era remains strong and healthy.

CoreLogic: Insured, Uninsured Damages for Hurricane Ian at $41-$70 Billion

CoreLogic, Irvine, said final damage estimates for Hurricane Ian could run as high as $70 billion—of which up to $17 billion could be uninsured.

CoreLogic: 30 Years After Hurricane Andrew, Problems Persist for Insurance, Mortgage Industries

CoreLogic, Irvine, Calif., said in the 30 years since Hurricane Andrew devastated much of South Florida, the risk management landscape has evolved “tremendously.” But many questions remain—and with South Florida still a popular place to live, many of the risks from 1992 still exist today.

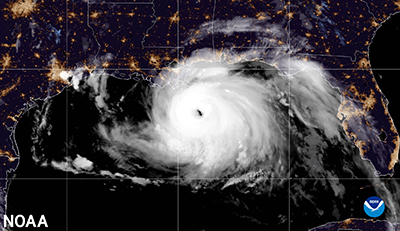

NOAA Sees Above-Normal Hurricane Season

Okay, all you holders of residential and commercial real estate along the Atlantic coast and the Gulf of Mexico: brace yourself for another potential summer of sandbags and insurance claims.

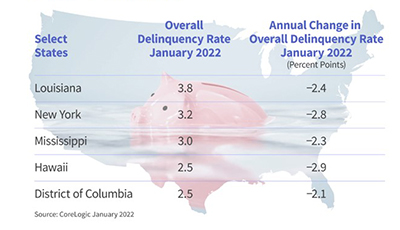

CoreLogic: Mortgage Delinquencies at 23-Year Low

CoreLogic, Irvine, Calif., said mortgage delinquencies fell in January to their lowest level since 1999.