The Consumer Financial Protection Bureau released research reporting consumers in majority Black and Hispanic neighborhoods, as well as younger consumers and those with low credit scores, are far more likely to have disputes appear on their credit reports.

Tag: Consumer Financial Protection Bureau

CFPB Proposed Rule Focuses on Small Business Access to Credit

The Consumer Financial Protection Bureau on Wednesday proposed a new rule aimed at increasing transparency in the small business lending marketplace.

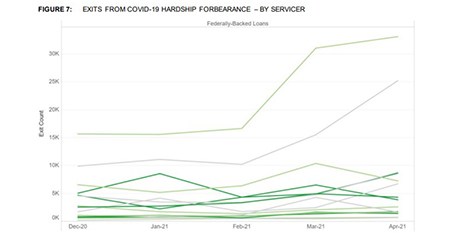

CFPB: Mortgage Servicers’ Pandemic Response Varies Significantly

The Consumer Financial Protection Bureau on Tuesday published a report detailing 16 large mortgage servicers’ COVID-19 pandemic response. The report showed a disparate response in call metrics, exit metrics and other measures.

CFPB: Credit Applications Mostly Recovered to Pre-Pandemic Levels

The Consumer Financial Protection Bureau published an issue brief showing consumer applications for auto loans, new mortgages and revolving credit cards had mostly returned to pre-pandemic levels by May.

Murali Tirupati: How Mortgage Servicers Can Improve Operations with an ‘Automation-First’ Strategy

mortgage servicers are under tremendous pressure to not just onboard loan files faster but do so in compliance with regulatory requirements of CFPB.

MBA Urges Federal Agencies to Clarify How AI Technologies Apply to Regs

The Mortgage Bankers Association last week asked federal regulatory agencies to clarify how existing fair lending and the Equal Credit Opportunity Act adverse action notification requirements apply to Artificial Intelligence technologies.

CFPB Report Finds ‘Wide-Ranging Violations of Law’ in 2020

The Consumer Financial Protection Bureau this week issued a report highlighting legal violations identified by the Bureau’s examinations in 2020.

CFPB Issues Rules on Transition as Federal Foreclosure Protections Expire

The Consumer Financial Protection Bureau on Monday finalized amendments to federal mortgage servicing regulations in response to federal foreclosure moratoria phasing out later this summer.

MBA, Lenders Seeks Clarity on Juneteenth Holiday Designation

With unusual speed and rare bipartisan agreement, Congress last week passed, and President Biden signed, legislation designating June 19—colloquially known as “Juneteenth”—a federal holiday, a move welcomed by Americans and supported by the Mortgage Bankers Association and thousands of businesses nationwide. But the speed of the designation—with Friday, June 18 designated a federal holiday—resulted in unintended consequences and disruption for the mortgage lending industry.

MBA, Trade Groups Urge Federal Agencies to Continue Alignment of QM/QRM Frameworks

The Mortgage Bankers Association and a half-dozen industry trade groups asked federal regulatory agencies to hold implementation of new credit risk retention guidelines until the Consumer Financial Protection Bureau implements its updated Qualified Mortgage general definition.