Last Tuesday, U.S. Federal Housing increased the conforming loan limit values for mortgages Fannie Mae and Freddie Mac will acquire in 2026. In most of the United States, the 2026 CLL value for one-unit properties will be $832,750, up $26,250 from 2025.

Tag: Conforming Loan Limits

FHFA Announces Increase to Conforming Loan Limit Values for 2024

The Federal Housing Finance Agency raised the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $766,550 in 2024, an increase of $40,350 from 2023.

2 Million U.S. Homes Eligible Under New GSE Conforming Loan Limits

Zillow Home Loans, Seattle, said recently announced new conforming limits for loans eligible to be sold to Fannie Mae and Freddie Mac mean nearly two million U.S. homes no longer require jumbo loans.

FHFA Raises 2023 GSE Conforming Loan Limits to $726,000

The Federal Housing Finance Agency on Tuesday increased the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $726,200, an increase of 12.21 percent ($79,000) from $647,200 in 2022.

2022 GSE Conforming Loan Limits Rise 18.5% to $647,200

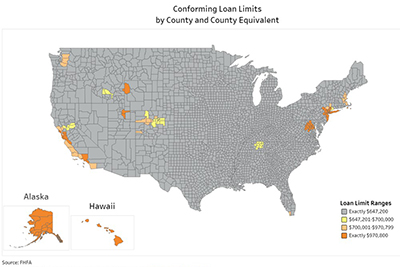

Conforming loan limits for Fannie Mae and Freddie Mac will rise to $647,200 jump in 2022, the Federal Housing Finance Agency said Nov. 30—a jump of nearly $100,000 from 2021’s previous record high.

FHFA: 2021 GSE Conforming Loan Limits Increase to $548,250

The Federal Housing Finance Agency on Nov. 24 announced a nearly $40,000 jump in maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2021.

FHFA Increases 2020 Maximum Conforming Loan Limits to $510,400

The Federal Housing Finance Agency last week announced maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2020, with the 2020 maximum conforming loan limit for one-unit properties rising to $510,400 from $484,350.