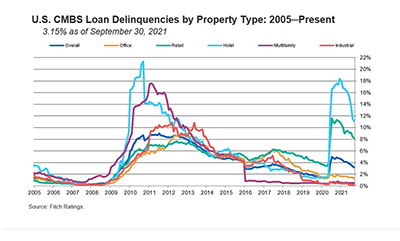

Fitch Ratings, New York, and Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate continued it steady fall in September.

Tag: Commercial Mortgage-Backed Securities

CMBS Delinquency Rate Shrinks, Cumulative Default Rate Increases

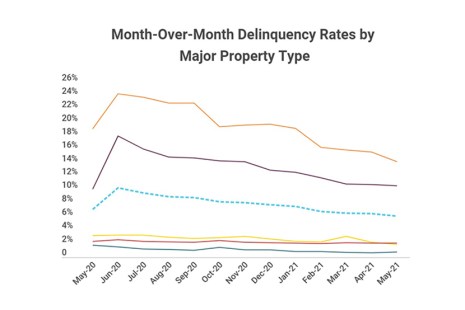

The commercial mortgage-backed securities delinquency rate continues to shrink, but the cumulative loan default rate increased slightly in first-half 2021, according to two new reports from S&P Global Ratings and Fitch Ratings.

CMBS Delinquency Rate Drops Sharply

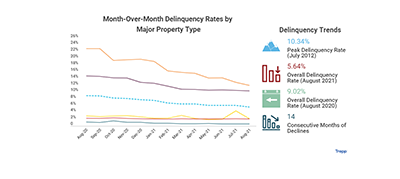

The commercial mortgage-backed securities delinquency rate declined sharply in August, posting the largest drop in six months, reported Trepp LLC, New York.

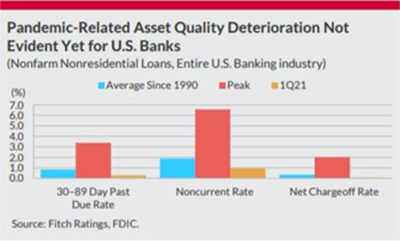

Fitch Ratings: Small U.S. Banks Most Exposed to Commercial Real Estate Losses

Fitch Ratings, Chicago, said the U.S. commercial real estate market will likely see deteriorating credit metrics once stimulus measures wind down and forbearance programs expire, with smaller CRE-concentrated banks more susceptible to elevated losses, which are expected to peak below levels seen in the past.

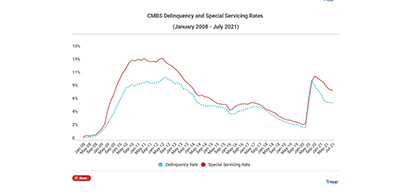

CMBS Delinquency, Special Servicing Rates Dip Again

“More of the same” was the commercial mortgage-backed securities delinquency rate headline in July, according to Trepp Senior Managing Director Manus Clancy.

CMBS Delinquency, Special Servicing Rates Improve

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in June–but not by much.

Most Senior CMBS Found ‘Resilient’ Under Stress Test

Most high investment-grade rated commercial mortgage-backed securities multi-borrower bonds can withstand downgrades under a new hypothetical stress test, Fitch Ratings reported last week.

CMBS Delinquency Rate Improvement Reaches 11-Month Mark

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in May, posting its biggest drop in three months.

CMBS Market Musings: Trophy Asset and Transitional Loan Transactions Thrive

The private-label CMBS market remains a mixed bag showing signs of a K-shaped recovery in the second quarter with delinquency and default numbers trending down now for nine consecutive months.

CMBS Supply-Demand Fundamentals Dip

Moody’s Investors Service, New York, said the supply and demand outlook for most property types in the securitized commercial real estate market dipped in fourth-quarter 2020.