Commercial mortgage delinquencies increased in the second quarter of 2025, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

Tag: Commercial Delinquencies

Chart of the Week: Latest Delinquency Rates and Range Since 1996

Commercial mortgage delinquencies increased across all major capital sources in the first quarter of 2025, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report. While overall delinquency rates remain relatively low by historical standards, the increases highlight growing stress in parts of the market, particularly in sectors facing refinancing challenges or weakened fundamentals.

MBA: Commercial Mortgage Delinquency Rates Increase in Third Quarter

Commercial mortgage delinquencies increased in the third quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

Commercial Mortgage Delinquency Rates Increased in the Second Quarter of 2024

Commercial mortgage delinquencies increased in the second quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

MBA: Commercial Mortgage Delinquency Rates Increased in First Quarter

Commercial mortgage delinquencies increased in the first quarter of 2024, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

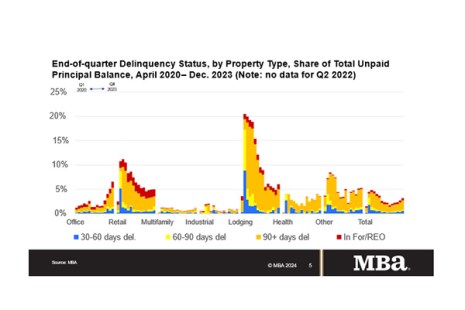

MBA Chart of the Week: End of Quarter Delinquency Status

Ongoing challenges in commercial real estate markets pushed the delinquency rate on CRE-backed loans higher in the final three months of 2023.

MBA: Commercial Mortgage Delinquency Rates Increased in Third Quarter

Commercial mortgage delinquencies increased in the third quarter, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

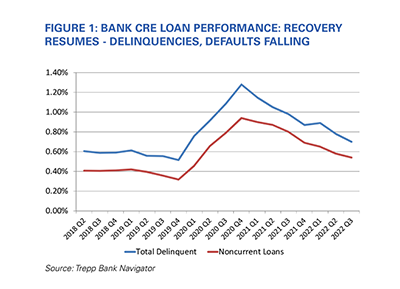

Bank Commercial Real Estate Loan Delinquency Dips

Trepp, New York, said delinquency rates for commercial real estate loans held by banks declined in third-quarter 2022 after increasing modestly earlier in the year.