According to the latest results from MBA’s National Delinquency Survey (NDS), the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.26% of all loans outstanding at the end of the fourth quarter of 2025.

Tag: Chart of the Week

Chart of the Week: Homeownership Rates by Age, Race and Ethnicity

In this week’s MBA Chart of the Week, we examine the homeownership rate by household age as well as by race and ethnicity.

Chart of the Week: Mortgage Rates, 10-Year Treasury and 30-10 Spread

The spread between mortgage rates and Treasury rates is impacted by several factors, including the level of interest rate volatility and the relative demand/supply balance of the two types of securities. In recent months, rate volatility has diminished, as the future course of monetary policy has become clearer and financial markets have been relatively calm. Last week’s announcement that the GSEs will increase their purchases of MBS brought the spread in further, and mortgage rates dropped further over the course of the week.

MBA Chart of the Week: Monthly Payroll Growth

The pace of employment growth slowed in December to 50,000 jobs, in line with the average pace of 49,000 for all of 2025. Employment growth was much slower than the roughly 168,000 job pace in 2024. Employment numbers for October and November were revised downwards by 76,000, considerably weaker than initially reported.

Chart of the Week: Employee Benefits Costs for Mortgage Lenders, Servicers

The beginning of the calendar year brings changes to employee benefits and associated costs for both mortgage company employers and employees. Based on data collected through the MBA and STRATMOR Peer Group Roundtables Program, this week’s Chart of the Week shows that residential lender-paid and servicer-paid costs have generally increased over the past five years, from 2020 to the first half of 2025, at a faster pace than the previous five years, from 2015 to 2020.

Chart of the Week: Median First-Time Homebuyer Age

The Washington Post recently published an article examining alternative estimates of first-time homebuyers’ age. MBA members have asked about this data, so this week’s Chart of the Week explores the Post’s analysis and current FTHB data trends.

Chart of the Week: ARM Share of Home Purchase Applications

According to data from MBA’s Builder Applications Survey, 24.6% of applications to purchase a newly built home were adjustable rate mortgage (ARM) loan applications in October.

Chart of the Week: Seriously Delinquent Loans by Loan Type

According to the latest MBA National Delinquency Survey, the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.99% of all loans outstanding at the end of the third quarter of 2025.

Chart of the Week: Retail Channel Mortgage Pull-Through

At last month’s MBA Annual Convention and Expo in Las Vegas, lenders discussed and debated ways to reduce origination costs and increase productivity by investing in more modern technology, refining the use of technology, and making the loan production process more efficient. Improved servicing recapture and offering a greater variety of non-agency loan products were also explored as ways to achieve scale and spread fixed costs over more origination volume.

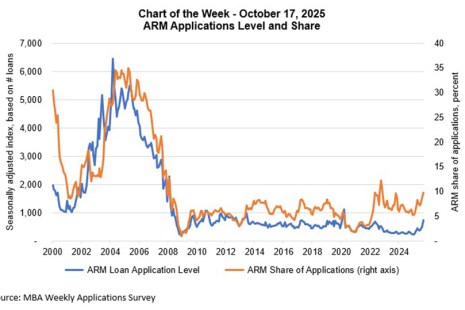

Chart of the Week: ARM Applications Level and Share

Adjustable-rate mortgages (ARMs), when used appropriately, can help ease affordability challenges and provide homeownership and equity building opportunities for qualified borrowers.