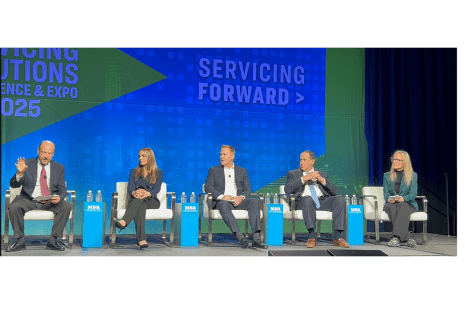

DALLAS–What’s next for the servicing industry when it comes to trends and challenges in technology, regulation and the overall market?

Tag: Cenlar

Mortgage Servicers Embrace Technology to Drive Better Homeowner Experiences: Cenlar’s Shanth Ananthuni

The mortgage industry has undergone significant transformation in recent years. Consumer behavior is rapidly evolving to the ever-changing tech landscape. Because we live in a world where we are increasingly dependent on technology, as servicers, we need to strike a balance between staying competitive in the marketplace while also providing the best possible homeowner experience.

Cenlar’s Tom Donatacci: The Golden Rule of Client Service

I have had a diverse, nearly 35-year career, with each chapter delivering experiences and tools that have helped me manage anything that comes my–or my client’s–way. The most significant accomplishments in my career have been when I’ve been able to surround myself with a strong team with diversified skills.

Cenlar’s Lori Pinto, CMB: Delivering the Best Homeowner Experience

The U.S. economy and housing market has been anything but predictable the last few years.

Cenlar’s Josh Reicher: Intelligent Automation Is Transforming Mortgage Servicing

The emergence of intelligent automation, which is the use of automation technologies–artificial intelligence, business process management and robotic process automation–is transforming how mortgage servicers do business.

Cenlar’s Sara Avery: Building an Effective Risk-Aware Culture

An organization is run by its people. Managing risk is a key factor to strategic business planning and success. So the saying that everyone is a risk manager may sound cliché and simple, but it’s absolute. How to effectively manage risk and build out a risk infrastructure has evolved dramatically through the years.