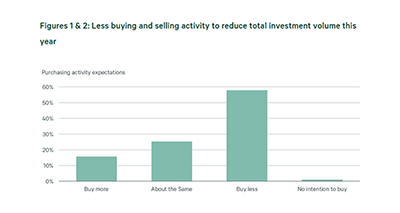

U.S. commercial real estate investors favor opportunistic strategies and show a preference for secondary markets amid concerns about higher interest rates and tighter financial market conditions, reported CBRE, Dallas.

Tag: CBRE

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

Bridge Over Troubled Water: Debt Funds and Mortgage REITs Come of Age During COVID-19

It can be challenging to raise capital for public companies involved in commercial real estate lending against a backdrop of falling stock prices. This has led to an inward focus on activities such as asset management and building liquidity for public mortgage REITs, making these market participants less active for new loan originations.

Office Vacancy Rate Could Reach 20% in 2022

The office sector saw downward pressure even before the COVID-19 crisis. Now, burdened with a shift toward remote working, it could be particularly hard hit in the coming years, said Moody’s Analytics, New York.

MBA: 2019 Multifamily Lending Up 7% to Record High

Fueled by strong market fundamentals and low interest rates, 2,589 different multifamily lenders provided $364.4 billion in new mortgages in 2019 for apartment buildings with five or more units, according to the Mortgage Bankers Association’s 2019 Multifamily Lending Report.

Hotel Sector Bouncing Back But Faces Continued Threats

CBRE, Los Angeles, said the hotel sector has seen 10 straight weeks of occupancy gains, but the recent COVID-19 diagnosis increase threatens to derail its progress.

CBRE Forecasts Hotel Demand Recovery by Late 2022

After suffering the greatest performance declines in U.S. history, the nation’s hotels will likely benefit from a relatively rapid economic turnaround in 2021 and 2022, said CBRE Hotels, Atlanta.

#CREF2020: PNC, Wells Fargo Lead MBA 2019 Year-End Commercial/Multifamily Servicer Rankings

SAN DIEGO–The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes as of December 31, here at the MBA 2020 Commercial Real Estate Finance/Multifamily Housing Convention & Expo.

#CREF2020: PNC, Wells Fargo Lead MBA 2019 Year-End Commercial/Multifamily Servicer Rankings

SAN DIEGO–The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes as of December 31, here at the MBA 2020 Commercial Real Estate Finance/Multifamily Housing Convention & Expo.