Black Knight, Jacksonville, Fla., said the national mortgage delinquency rate fell below 6% for the first time since nearly a year, but cautioned some 2.1 million homeowners remain seriously delinquent on their mortgage payments.

Tag: Black Knight

Black Knight First Look: 2020 Ends with Higher Delinquencies, Lower Foreclosures

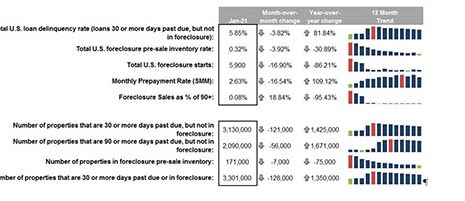

Black Knight, Jacksonville, Fla., said 2020 ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of the year, a looming reminder of the challenges facing the market in 2021.

Black Knight First Look: Early-Stage Delinquencies Improve, Serious Past-Due Loans Rise

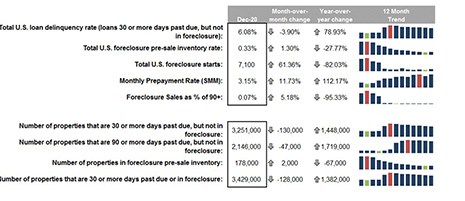

Black Knight, Jacksonville, Fla., issued its monthly First Look Mortgage Monitor, reporting the divergence between early-stage delinquencies and seriously past-due mortgages continues to widen as fewer delinquent loans cured to current status in August.

Black Knight: Refi Surge Spurs Record Quarterly Origination Volume

Black Knight, Jacksonville, said record-low mortgage rates triggered a surge in refinancing in the second quarter, leading to the largest quarterly origination volume dating back to 2000.

Black Knight: Mixed Results on Delinquencies; Monthly Prepayment Activity Hits 16-Year High

Black Knight, Jacksonville, Fla., said its “First Look” Mortgage Monitor showed while overall delinquencies continued to show improvement, serious delinquencies rose by 376,000 and are now up more than 1.8 million from their pre-pandemic levels.

Black Knight: Mortgage Delinquencies Improve for the First Time Since January; Serious Delinquencies Surge to 9-Year High

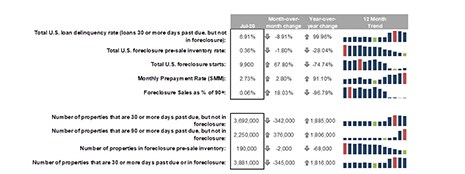

Black Knight, Jacksonville, Fla., said after rising from 3.2% in January to 7.8% in May, the national delinquency rate improved for the first time in five months, falling to 7.6% in June as the overall number of past-due mortgages declined by 98,000.

Black Knight: Cash-Out Refinances Fall Despite Record-High Tappable Equity

Black Knight, Jacksonville, Fla., said homeowners’ tappable equity rose by 8% annually in the first quarter to a record-high $6.5 trillion.

Black Knight: 1 in 10 Homeowners in Forbearance Hold 10% or Less Equity in Their Homes

Black Knight, Jacksonville, Fla., said with its analysis of borrowers in forbearance showing forbearance volumes falling for the first time since the crisis began, industry participants – especially servicers and mortgage investors – must now shift from pipeline growth to pipeline management and downstream performance of loans in forbearance.

Black Knight ‘First Look:’ March Delinquencies First Sign of Coronavirus Impact

March is usually the strongest month of the year for mortgage performance, says Black Knight, Jacksonville, Fla. Not this year.

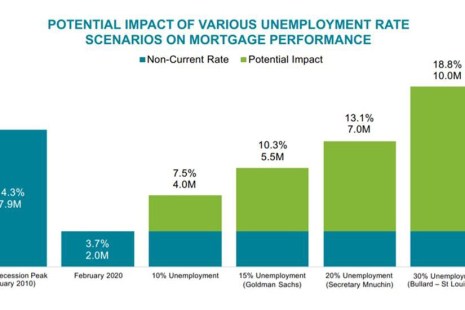

Black Knight: COVID-19 Unemployment Spike Triggering Surge in Mortgage Forbearance Requests

Leading up to the coronavirus outbreak, said Black Knight, Jacksonville, Fla., the vast majority of mortgage performance metrics were at or near record levels. Now, says Black Knight Data & Analytics President Ben Graboske, the mortgage market has been turned upside down.