Black Knight, Jacksonville, said record-low mortgage rates triggered a surge in refinancing in the second quarter, leading to the largest quarterly origination volume dating back to 2000.

Tag: Ben Graboske

Black Knight: Cash-Out Refinances Fall Despite Record-High Tappable Equity

Black Knight, Jacksonville, Fla., said homeowners’ tappable equity rose by 8% annually in the first quarter to a record-high $6.5 trillion.

Black Knight: 1 in 10 Homeowners in Forbearance Hold 10% or Less Equity in Their Homes

Black Knight, Jacksonville, Fla., said with its analysis of borrowers in forbearance showing forbearance volumes falling for the first time since the crisis began, industry participants – especially servicers and mortgage investors – must now shift from pipeline growth to pipeline management and downstream performance of loans in forbearance.

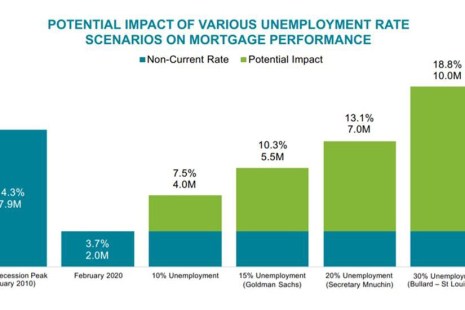

Black Knight: COVID-19 Unemployment Spike Triggering Surge in Mortgage Forbearance Requests

Leading up to the coronavirus outbreak, said Black Knight, Jacksonville, Fla., the vast majority of mortgage performance metrics were at or near record levels. Now, says Black Knight Data & Analytics President Ben Graboske, the mortgage market has been turned upside down.

Black Knight: Servicer Retention Rates Fall in Q3 Despite 3-Year High in Refinance Volumes

Black Knight, Jacksonville, Fla., said after hitting an 18-year low in Q4 2018, refinance lending has nearly doubled (+94%) over the past three quarters.

Black Knight: First-Time Homebuyers ‘Under Pressure’ as Early-Stage Delinquencies Rise

Black Knight, Jacksonville, Fla., said nearly 1% of first quarter originations became delinquent six months post-origination. Though this represented less than one-third of the 2000-2005 delinquency average of 2.93%, it is up more than 60% over the past 24 months and the highest since 2010.