ATTOM, Irvine, Calif., said profit margins on typical home sales hit another record in the second quarter amid the fastest rise in home prices in more than a decade.

Tag: ATTOM

ATTOM: Foreclosure Activity Jumps 219% in 1st Half of Year

ATTOM, Irvine, Calif., said foreclosure starts jumped by 219 percent in the first six months of 2022, close to pre-COVID levels.

ATTOM: New Jersey, Illinois, California Have Highest Concentration of ‘Vulnerable’ Housing Markets

ATTOM, Irvine, Calif., released a Special Housing Risk Report spotlighting county-level housing markets around the United States that are more or less vulnerable to declines, based on home affordability, unemployment and other measures in the first quarter.

Results Mixed on Spring Foreclosure Activity

New reports present a mixed bag on U.S. foreclosures, with CoreLogic, Irvine, Calif., reporting a new low in foreclosure rates, while ATTOM, Irvine, reported an uptick in foreclosure activity.

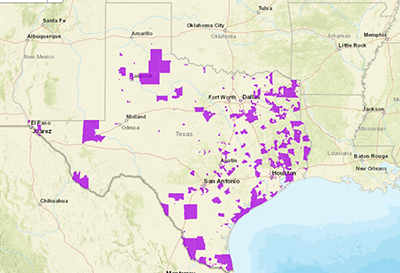

Home Values in ‘Opportunity Zones’ Keep Pace with National Gains

Home values in federal and state Opportunity Zone Redevelopment Areas—the controversial zones created in 2017 to spur economic development—are keeping up with nationwide home values, reported ATTOM, Irvine, Calif.

‘Zombie’ Properties Increase Amid Jump in Foreclosure Activity

ATTOM, Irvine, Calif., said residential properties in the process of foreclosure rose by nearly 13 percent in the second quarter and by nearly 16 percent from a year ago.

Nearly Half of U.S. Homeowners Equity-Rich

ATTOM, Irvine, Calif., reported 44.9 percent of mortgaged residential properties in the United States were considered equity-rich in the first quarter, up by more than 15 percent from just a year ago.

ATTOM: April Foreclosures Down 8% Monthly, Up from Year Ago

ATTOM, Irvine, Calif., reported properties with foreclosure filings in April fell by 8 percent from March but jumped by 160 percent from a year ago. Completed foreclosures, meanwhile, fell by 36 percent from March.

ATTOM: 1Q Home Sales, Seller Profits Decline

ATTOM, Irvine, Calif., said profit margins on median-priced single-family home sales across the United States dipped to 47.2 percent in the first quarter – the first quarterly decline since late 2019 and the largest in a decade.

Home Flipping Profits Fall to 10-Year Low

Although home flipping increased by more than 26 percent in 2021, ATTOM, Irvine, Calif., said gross profit margins fell to their lowest level in 10 years and at a pace not seen in 15 years.