MBA’s President and CEO Bob Broeksmit, CMB, released a statement on President Donald Trump’s executive order on artificial intelligence.

Tag: AI

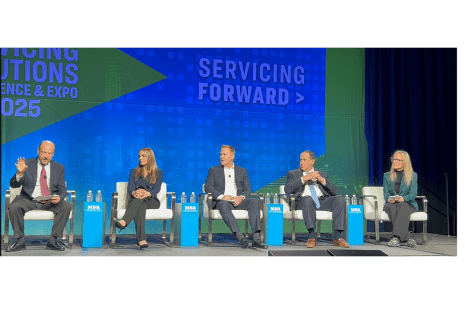

Panel Tackles AI, Customer Experience

LAS VEGAS–What impact will AI have on the mortgage banking industry? Is it a bubble? How does it fit into the customer experience?

MISMO Publishes Artificial Intelligence Glossary

MISMO, the real estate finance industry’s standards organization, announced the release of the Artificial Intelligence (AI) Glossary, a resource designed to establish a shared vocabulary for AI across mortgage finance.

MBA Premier Member Editorial: How AI Can Help Turn Customer Experience Into a Revenue Engine

For mortgage servicers and lenders, the contact center has long been viewed as a cost of doing business–a necessary function to resolve issues, manage complaints, and stay compliant. But what if AI could make that very same function a source of strategic growth?

MBA Premier Member Editorial: Tech and AI Are Advancing, So What’s Next for Mortgage Pricing?

Today, conversations around mortgage pricing tend to focus on AI and modern technology, yet there was a time when everything was handled very differently – before the first product, pricing, and eligibility engine was even introduced, Optimal Blue’s Mike Vough writes.

MBA Premier Member Editorial: Breaking the Bottleneck: How AI Accelerates the Lending Lifecycle

Tavant Touchless Lending’s Shannon Johnson writes that Artificial Intelligence is revolutionizing the mortgage landscape by addressing persistent challenges head-on.

First American’s Sarah Frano on AI-Driven Fraud: The Hidden Threat in Real Estate

The tools and technologies powered by artificial intelligence continue to evolve rapidly, and while the real estate industry is harnessing AI to automate everything from property valuations and predictive analytics to customer relationship management and fraud prevention, scammers are harnessing AI to identify targets, rapidly scale their schemes and avoid detection.

Servicing Panel Talks AI, Insurance, Future Trends

DALLAS–What’s next for the servicing industry when it comes to trends and challenges in technology, regulation and the overall market?

Servicing NewsLink Q&A: PhoenixTeam’s Tela Mathias Talks GenAI, Thursday’s Speed Learning Webinar

AI expert Tela Mathias and MBA Education will hold a webinar for mortgage professionals seeking an understanding of Artificial Intelligence in mortgage lending on Jan. 16. Mathias joined NewsLink to preview Thursday’s “speed learning” webinar.

How Can AI Actually Help the Mortgage Industry? Annual24 Panel Weighs In

DENVER–It’s no secret that artificial intelligence is an increasingly hot topic, and there are real applications to consider for those working in mortgage banking and related industries, said experts from Amazon Web Services and NVIDIA Corp., at MBA’s Annual Convention & Expo Oct. 29.