Air-tight QC policies and procedures are central to lenders’ ability to rely on servicing revenue in a down market.

Tag: ACES Quality Management

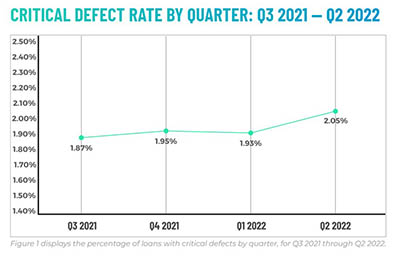

ACES: Critical Defect Rates Up 6%

ACES Quality Management, Denver, issued its quarterly Mortgage QC Industry Trends Report, showing the overall critical defect rate increased by 6% in the second quarter to 2.05%, crossing the 2% threshold for only the third time in this report’s history.

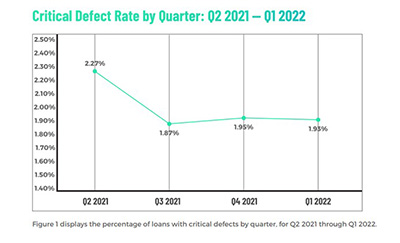

Critical Defect Rate Falls for 2nd Straight Quarter

ACES Quality Management, Denver, said the overall critical defect rate declined for the second straight quarter despite a more challenging mortgage lending environment.

Sponsored Content from ACES Quality Management: Prep Your Audit Process for Fair Servicing

Given regulators’ renewed focus on fair lending and fair servicing, learn how to enhance your audit practices to meet regulatory expectations in 2022 and beyond.

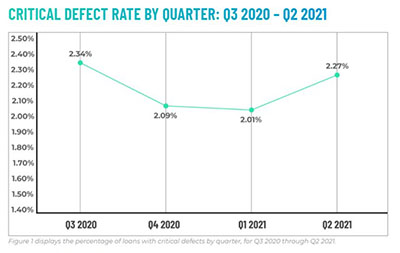

ACES: Q2 Critical Defect Rate Up 13%

ACES Quality Management, Denver, reported a13% increase in overall critical defect rates to 2.27%, ending a multi-quarter trend of improvement.

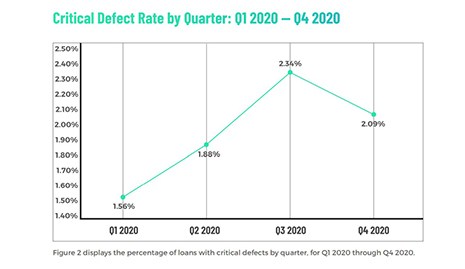

ACES: Q4 Critical Defect Rate Moderates, But Remains High

ACES Quality Management, Denver, said overall critical defect rates improved in the fourth quarter but remained high for calendar year 2020.

Nick Volpe: A Brief History of Defects; Q3 2020’s Loan Quality Performance Sets Stage for Areas of Concern in 2021

Lenders have a great deal to learn from their post-closing quality control analyses, even more so given the market disruptions and macroeconomic impact of COVID-19.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

Michael Steer: A New Year, A New Regulatory Attitude?

Lenders can adapt the current pandemic regulatory attitude into one that pays equal mind to both the pandemic and the importance of compliance.