ACES Finds Modest Rise in Critical Defect Rate

(Image courtesy of Anna Shvets/pexels.com)

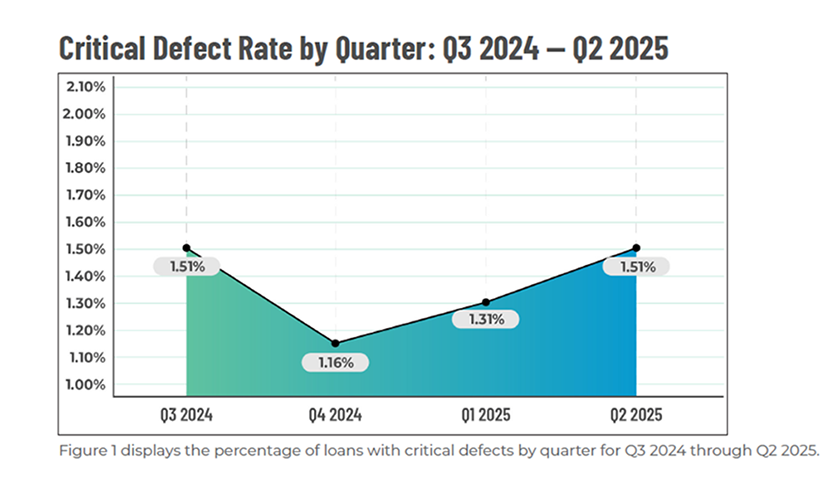

ACES Quality Management, Denver, found the overall critical defect rate increased from 1.31% in the first quarter of 2025 to 1.51% in the second.

The firm’s quarterly ACES Mortgage QC Industry Trends Report analyzes post-closing quality control data derived from ACES’ Quality Management & Control software. It found that appraisal defects surged 156.5%, while Borrower/Mortgage Eligibility defects more than doubled to 15.87%.

Nick Volpe, executive vice president at ACES Quality Management, noted that although the overall critical defect rate increased for a second straight quarter, the situation is nuanced. “The rise was mainly in specific categories such as appraisals and eligibility-related areas,” he said. “Meanwhile, other key underwriting areas saw notable improvements. This mixed performance demonstrates the importance of continuous monitoring and targeted quality control efforts.”

ACES found that Income/Employment defects improved 19.7%, falling from 22.99% to 18.45% of all critical defects. Loan Documentation and Insurance defects declined 32.6% and 25.2%, respectively.

Purchase defect share decreased to 73.96%, while refinance defect share climbed to 26.04% amid increased cash-out activity.

“Conventional loan quality improved, while FHA and VA findings rose modestly,” the report said.