VantageScore: Credit Scores Recover Overall, but Mortgage Delinquencies Grow

(Image courtesy of VantageScore; Breakout image courtesy of Mohamed hamdi/pexels.com)

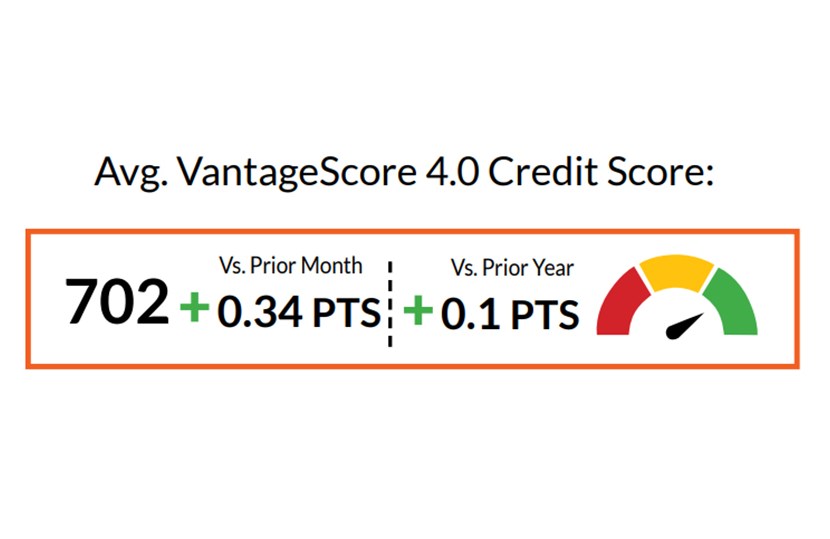

VantageScore, San Francisco, released its CreditGauge for March, finding that the average VantageScore 4.0 credit score returned to 702 after dipping slightly in February.

Overall, the CreditGauge found a broad-based decline in delinquencies across credit products and days-past-due categories and lower balance-to-loan and utilization ratios.

“The latest CreditGauge insights show an emerging dichotomy between stable Main Street consumer behavior and the intense volatility on Wall Street,” said Susan Fahy, Executive Vice President and Chief Digital Officer at VantageScore. “Consumers are slowly moderating their borrowing and focusing on bringing their accounts up to date as banks tighten new lending in March.”

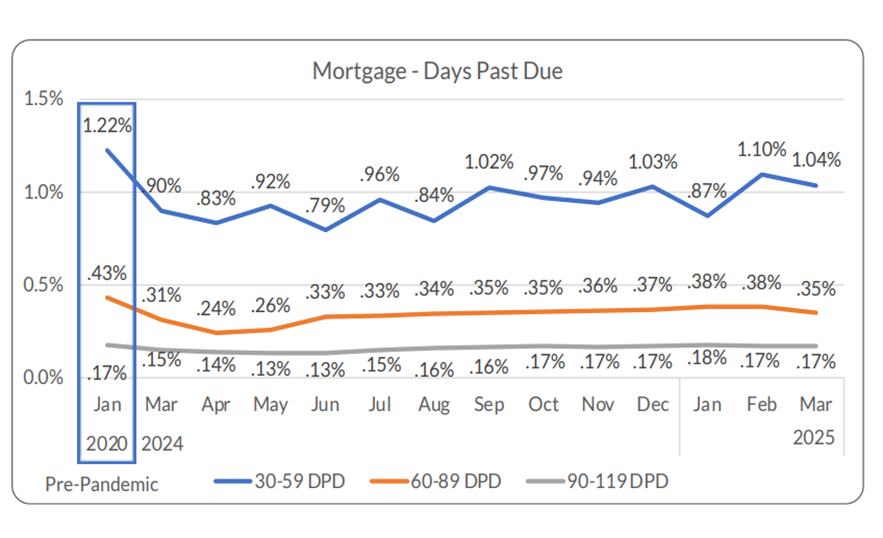

However, looking specifically at mortgages, mortgage credit delinquencies experienced the largest year-over-year increase in the 30-59 days-past-due category, jumping from 0.9% to 1.04%.

Year-over-year, mortgage credit delinquencies in the 60-89 days-past-due category were also up, from 0.31% to 0.35%, and in the 90-119 days-past-due, from 0.15% to 0.17%.

In 13-month delinquency rate trends, mortgages were the only product to see consistent year-over-year increases across all delinquency stages, “suggesting growing and sustained pressure in housing-related credit,” the report stated.

In March, the average mortgage balance rose $6,793 (or 2.6%) year-over-year and $568 from February. However, the balance-to-loan ratio did drop slightly to 80.08%.

Year-over-year, mortgage originations declined across all generations, with Gen Z seeing the sharpest drop.

Month-over-month, originations increased narrowly for Gen Z and millennials, fell for the Silent generation and Baby Boomers, and were flat for Gen X.