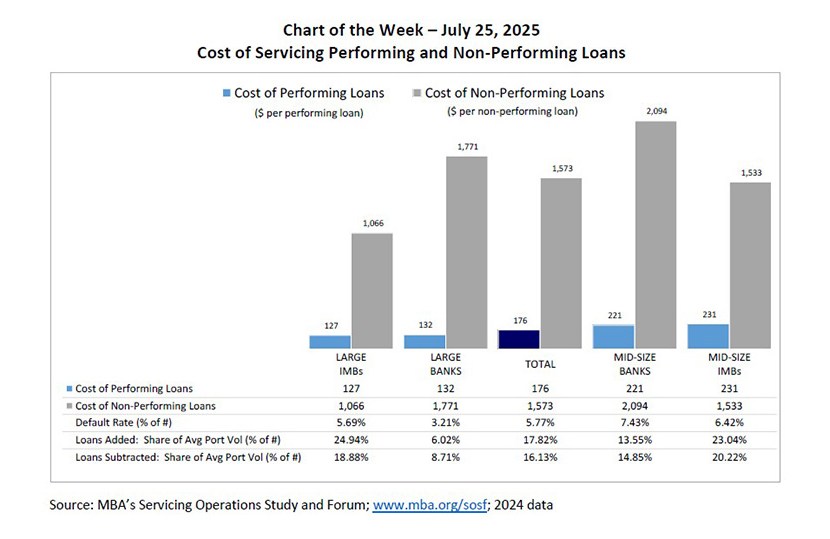

Chart of the Week: Cost of Servicing Performing and Non-Performing Loans

Based on results from MBA’s latest Servicing Operations Study and Forum (SOSF), fully-loaded mortgage servicing costs of performing loans averaged $176 per loan in 2024, while the costs of non-performing loans averaged $1,573 per loan. These results are derived from a sample of in-house servicers, representing approximately 60% of the single-family servicing market.

In today’s Chart of the Week, the costs of performing and non-performing are segmented into four major peer groups: large independent mortgage companies (IMBs) and banks with average servicing portfolios of 1.8 million loans and 1.6 million loans, respectively; and mid-size IMBs and banks with average servicing portfolios of 195,000 loans and 240,000 loans, respectively. Helped by economies of scale, the large IMB and large bank peer groups averaged between $127 and $132 in cost per performing loan, while costs for both mid-size servicer groups were approximately $100 per loan higher. As for non-performing loans, the two independent peer groups had lower costs compared to the two bank peer groups. Several reasons may be at play: varying default organizational structures and procedures, the extent of outsourcing of default functions, and differences in the product mix of defaulted loans.

Of all four peer groups, the large IMBs garnered the lowest cost to service both performing loans and non-performing loans. The large IMBs also happen to be the fastest growing peer group, with loans added to servicing portfolios substantially outpacing the loans leaving servicing portfolios in 2024.

Definitional Notes:

• The costs associated with servicing performing loans include the base direct costs to service any loan, regardless of default status: call center, technology, escrow, cashiering, investor reporting, and executive management, among others. In addition, corporate overhead costs are included.

• The costs of servicing non-performing loans include the same base direct costs and corporate overhead, as well as the following additional costs: collections, loss mitigation, bankruptcy, foreclosure and post-sale, unreimbursed foreclosure and real estate owned (REO) losses, and other default-specific costs.

Non-performing loans include loans 30 or more days delinquent and loans in foreclosure or in REO status prior to investor conveyance. For study purposes, MBA treats loans that missed mortgage payments but were in forbearance as non-performing.

Marina Walsh, CMB (mwalsh@mba.org)