Cotality: Taxes, Insurance Appear to Drive Some Increase in Serious Delinquencies

(Image courtesy of Cotality)

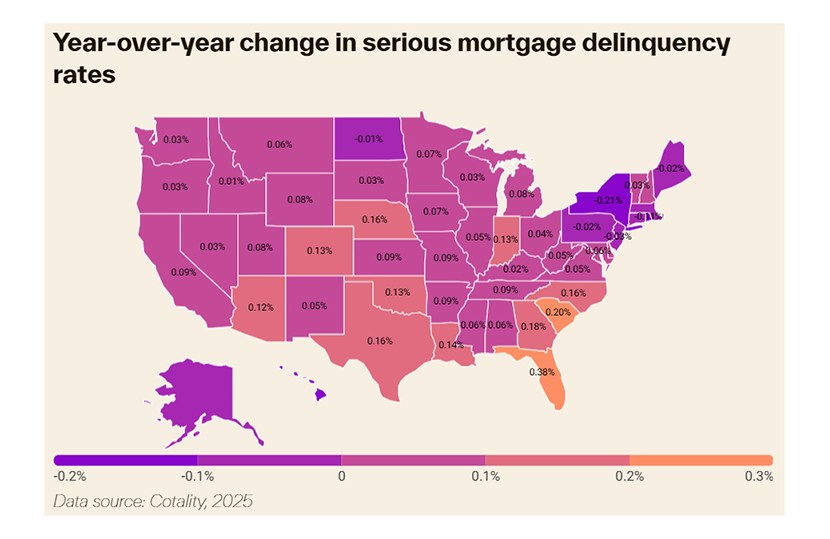

Cotality, Irvine, Calif., released a new report analyzing the effects of property taxes and insurance in states seeing upticks in serious mortgage delinquencies.

Serious delinquencies started to edge up in mid-2024. For some states–particularly those with recent significant natural disasters–there have been notable jumps in serious delinquencies paired with increases in escrow payments due to rising taxes and/or insurance costs.

For example, Florida has a serious delinquency rate of 1.43% (up 38 basis points year-over-year), combined with a 62% increase in escrow payments from 2019-2024.

South Carolina has a serious delinquency rate of 1.05% (up 20 basis points year-over-year) and a 37% increase in escrow payments over that period.

Georgia has a rate of 1.12% (up 18 basis points), and a 38% increase in escrow payments; Nebraska has a rate of 0.81% (up 16 basis points) and a 43% increase in escrow payments; and Texas has a rate of 1.11% (up 16 basis points) and a 21% increase in escrow payments.

Also in the top 10, based on the year-over-year change in serious delinquency rates, are North Carolina, Louisiana, Colorado, Indiana and Oklahoma. Increases to escrow payments between 2019-2024 in those five states range from 38% (Oklahoma) to 62% (Colorado).

Nationwide, property tax bills are 15.4% more than they were right before the COVID-19 pandemic, Cotality stated.

Cotality also noted that government-backed loans like those offered by the Federal Housing Administration and the Department of Veteran Affairs are seeing higher serious delinquency rates than conventional loans.

“It appears those trying to make homeownership work on modest incomes are now being hit first, and hardest, by the rising costs that weren’t calculated into escrow obligations when they signed their loan papers,” the report stated.