Achieve Survey: Americans’ Financial Trends Stable, but Challenges Remain

(Image courtesy of Liza Summer/pexels.com)

Achieve, San Mateo, Calif., released its quarterly debt survey, finding that 26% of households report accruing more debt over the past quarter. However, that’s down from the 28% that said the same in Q4 2024.

Thirty-five percent of respondents successfully decreased their total debt, compared with 31% in Q4; 39% reported it remained flat, compared with 42% in Q4.

However, 57% report that they are carrying a credit card balance to cover essential expenses. That’s down from 58% last quarter, and about half of those respondents have had their debt for more than six months.

“Achieve’s latest household debt data shifted slightly in a positive direction, but we can’t ignore the long-term financial impact debt has on consumers,” said Achieve Co-Founder and Co-CEO Andrew Housser. “For people struggling to make ends meet and who feel like they have no other option but to take on more debt, it can take months, if not years, to regain financial stability.”

In addition, 36% of respondents find it difficult to pay their debt on time, flat from the past three quarters. The reasons they gave include insufficient income (68%), owing on too many accounts (36%) and cash-flow issues (27%).

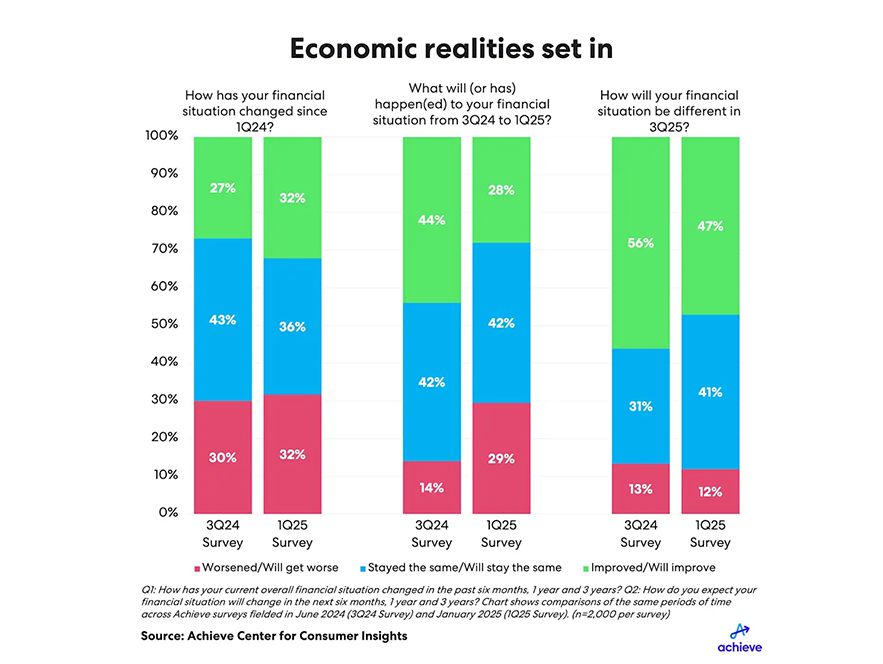

In terms of general sentiment, 28% of respondents said their financial situation improved in the last six months of 2024, and 29% said their situation worsened. Asked to look forward to the third quarter, 47% said they expect their finances will improve, down from 56% in Q3 2024.