Optimal Blue: December Brought Significant Growth in Rate/Term Refinance Volume

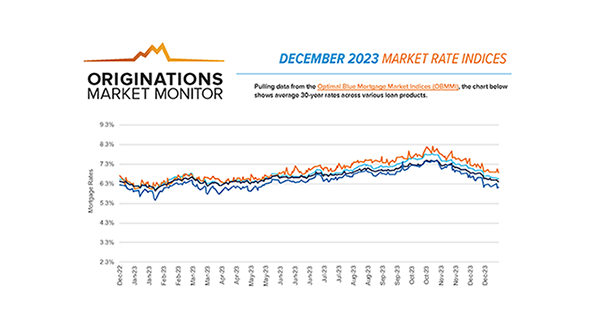

(Chart courtesy of Optimal Blue)

Interest rate drops in late 2023 spurred big changes, including a 43% increase in rate/term refinance volume between November and December, according to Optimal Blue, Plano, Texas.

The total refinance share of locks rose to 19% in December–the highest level since April 2022–despite cash-out volume declining 9%, Optimal Blue Data Solutions Manager Brennan O’Connell said.

Optimal Blue examined mortgage origination data through December using daily rate lock data from the Optimal Blue Product and Pricing Engine to produce its Originations Market Monitor report.

“Mortgage rates continued to fall in December, with the Fed delivering welcomed commentary suggesting rates may have peaked with cuts on the horizon in 2024,” O’Connell said. “However, the improving rate environment had little impact on purchase lending, where lock volume fell 23% in December, traditionally the slowest month for homebuyer activity.”

Optimal Blue reported the growth in rate/term volume was largely driven by a material uptick in VA Interest Rate Reduction Refinance Loans. IRRRL volume hit its highest level since January 2022, and the total refinance share of VA volume rose to nearly 30%. As a result, VA volume saw the highest market share gain in December, rising 137 basis points to finish the month at 11.8% of total volume.

FHA refinance volume also ticked up in December, despite FHA total volume dropping 105 basis points of market share to 21.5% of total volume, the report said. The GSE-eligible share rose 36 basis points to 56.6% and nonconforming volume–inclusive of jumbo and non-QM–dropped 72 basis points to 9.4%.

The adjustable-rate mortgage share of locks continued to fall, dropping to 5.2% of total volume, indicating further fading of consumer interest in the product, Optimal Blue reported.