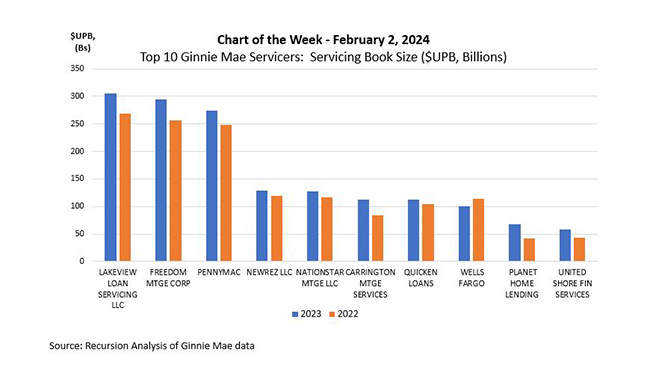

MBA Chart of the Week: Top 10 Ginnie Mae Servicers

Source: Recursion Analysis of Ginnie Mae data

This week’s MBA Chart of the Week highlights analysis by Recursion, a big data mortgage analytics firm, that ranks the 10 largest Ginnie servicers by servicing book size ($UPB).

Nine of the top 10 Ginnie servicers in 2023 were non-depositories, and all saw annual gains in servicing book size in 2023, with growth rates ranging from 7% to 60%.

Non-depositories accounted for about 60% of total mortgage originations in 2022, having grown from a 30 to 40% market share a decade earlier, based on the most current available data from the Home Mortgage Disclosure Act (HMDA). Government lending played a big part in this growth; non-depositories accounted for 87% of FHA originations and 81% of VA originations in 2022. Additionally, FHA and VA originations accounted for 21% of total origination units and 19% of total dollar volume in 2022.

A higher market share of government originations has led to a higher share of government servicing. Data from MBA’s Quarterly Performance Report showed that lenders with a majority government share of originations retained servicing on an average of 36% of their origination volume. In comparison, lenders with less than 50% government volume retained servicing for an average of 18% of their origination volume in the third quarter of 2023.

Will the non-depository share of Ginnie Mae servicing continue to increase? Given their growing market share of government loan originations and the proposed increase in capital requirements for banks holding mortgage servicing rights (MSR), it seems likely.

For more data from Recursion available to MBA members, see the MBA Members-Only Research Page.

-Mike Fratantoni, Joel Kan, Marina Walsh, CMB