ATTOM Finds Foreclosure Filings Rise in First Quarter

(Image courtesy of ATTOM)

ATTOM, Irvine, Calif., found 95,349 U.S. properties with foreclosure filings during the first quarter, up 3% from the previous quarter but down less than 1% from a year ago.

The firm’s Q1 2024 U.S. Foreclosure Market Report also shows a total of 32,878 U.S. properties with foreclosure filings in March, down less than 1% from the previous month and down 10% from a year ago.

“Q1 2024’s foreclosure data reveals a market in transition, with slight increases in filings and starts, alongside a notable decrease in REO properties,” ATTOM CEO Rob Barber said. “While foreclosures remain relatively stable, we’re closely monitoring these trends. Homeowners continue to hold significant equity, contributing to a persistently hot housing market.”

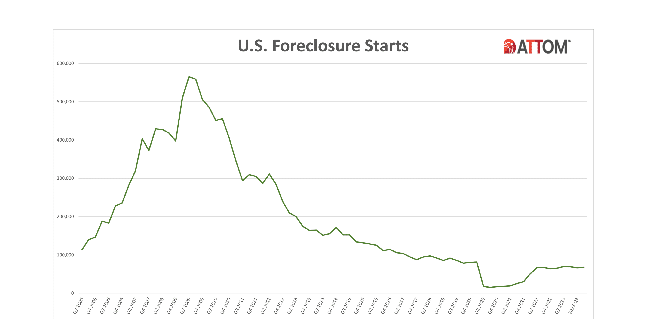

Foreclosure Starts Increase Nationwide

A total of 67,657 U.S. properties started the foreclosure process in the first quarter, up 2% from the previous quarter and up 4% from a year ago.

States that saw the greatest quarterly increase in foreclosure filings included New Hampshire (up 43%), Illinois (up 26%), Florida (up 22%), Rhode Island (up 21%) and Nevada (up 16%), ATTOM reported.

Major metros that had the greatest number of foreclosures starts included New York City (4,404 foreclosure starts), Houston (2,977 foreclosure starts), Chicago (2,867 foreclosure starts), Los Angeles (2,398 foreclosure starts) and Miami (2,319 foreclosure starts).

Nationwide, one in every 1,478 housing units had a foreclosure filing during the quarter. States with the highest foreclosure rates were Delaware (one in every 894 housing units with a foreclosure filing), New Jersey (one in every 919 housing units), South Carolina (one in every 929 housing units), Nevada (one in every 961 housing units) and Florida (one in every 973 housing units).

The report said lenders repossessed 10,052 U.S. properties through foreclosure (REO) in the quarter, up 7% from the previous quarter but down 20% from a year ago.