CoreLogic: Historic Low for Delinquencies in August

(Image courtesy of CoreLogic)

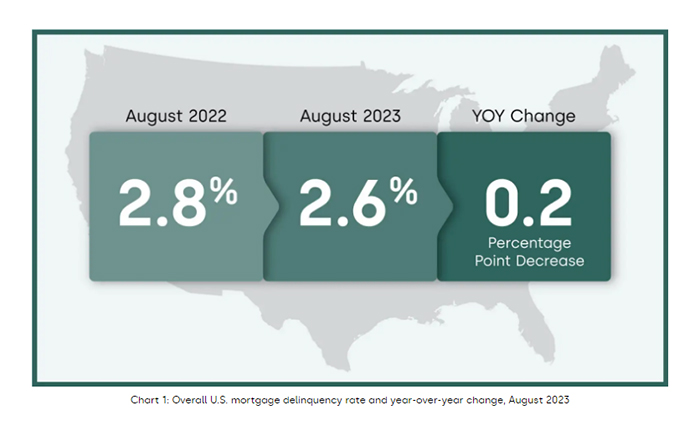

CoreLogic, Irvine, Calif., found in its Loan Performance Insights Report for August that the overall mortgage delinquency rate was at 2.6%, a historic low.

That compares with 2.8% in August 2022 and 2.7% in July 2023.

“U.S. mortgage performance remained strong in August, supported by a robust job market and a healthy economy,” said Molly Boesel, principal economist at CoreLogic. “However, this thriving job market comes at a time when interest rates are quickly rising, which is keeping many potential homebuyers from being able to secure a mortgage.”

In terms of stages of delinquency:

• Early stage delinquencies (defined as 30-59 days past due) were 1.3%, up from 1.2% in August 2022.

• Adverse delinquencies (defined as 60-89 days past due) were 0.4%, up from 0.3% in August 2022.

• Serious delinquencies (defined as 90 or more days past due) were 0.9%, down from 1.2% in August 2022. That’s also the lowest rate since January 1999.

• The foreclosure inventory rate was 0.3%, the same as August 2022.

• The transition rate (defined as the share of mortgages that transitioned from current to 30 days past due) was 0.6%, the same as August 2022.

Idaho and Utah were the only states to post annual increases in their overall delinquency rates; both were up by 0.1 percentage point. Arizona, Florida, Indiana and Oregon were unchanged, and the remaining states saw declining rates.

The metros with the largest increases in year-over-year delinquency rates were Elkhart-Goshen, Ind., at a 0.6 percentage point increase, and Kokomo, Ind., and Punta Gorda, Fla., both up by 0.5 percentage point. Forty-eight other metro areas posted increases.

Metro areas with increases in serious delinquency rates were Punta Gorda, Fla., up by 0.5 percentage point; Cape Coral/Fort Myers, Fla., up by 0.4 percentage point; and Cheyenne, Wyo., up by 0.1 percentage point.