Trepp: Special Servicing Rate Climbs in September

(Image courtesy of Trepp)

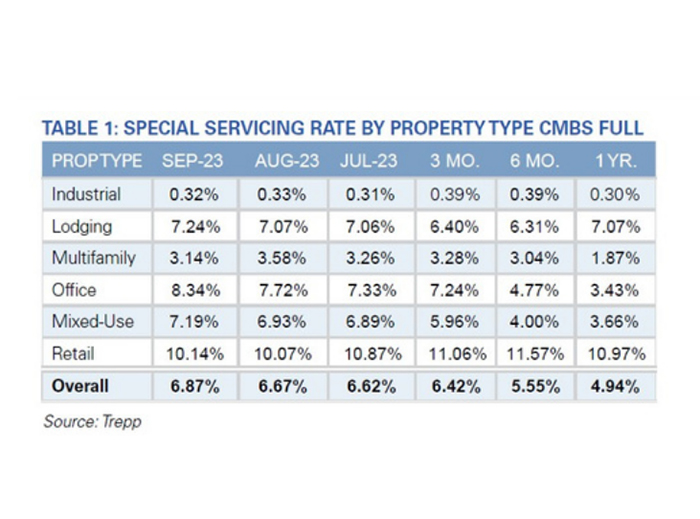

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

The rate, which was at 5.11% at the beginning of the year, has risen every month since.

Last year, it was 4.94%, and six months ago it was 5.55%.

In September, $2.41 billion in loans was transferred to the special servicer–office properties were 54% of that, lodging properties were 19.2% and retail properties were 12.9%.

The overall CMBS 2.0+ special servicing rate is 6.67%, compared with 4.66% last year and 5.31% six months ago.

The overall CMBS 1.0 special servicing rate is 32.72%, compared with 36.19% a year ago and 34.49% six months ago.

For both CMBS 1.0 and 2.0+, overall property types broke down as following:

• The industrial special servicing rate was at 0.32%, with no change.

• The lodging special servicing rate was 7.24%, up 17 basis points.

• The multifamily special servicing rate was 3.14%, down 44 basis points.

• The office special servicing rate was 8.34%, up 62 basis points.

• The mixed-use special servicing rate was 7.19%, up 26 basis points.

• The retail special servicing rate was 10.14%, up 8 basis points.

The two largest loans to enter special servicing was a $415 million Courtyard by Marriott Portfolio loan, and a $350 million loan for 1407 Broadway in New York.