ICE First Look for October: Serious Delinquencies Hit Lowest Levels Since 2006

(Image courtesy of ICE)

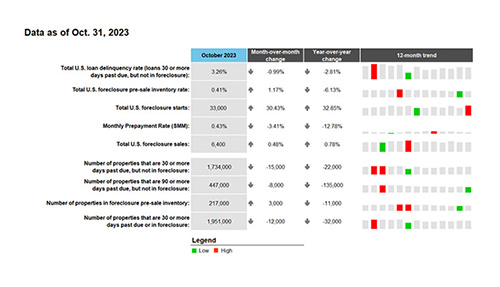

Intercontinental Exchange Inc., Atlanta, released its “first look” at October 2023 month-end mortgage performance statistics, noting that serious delinquencies have fallen to their lowest level in 17 years.

Serious delinquencies nationwide fell to 447,000.

The national delinquency rate fell by 3 basis points to 3.26% in October, a 9-basis-point improvement from October 2022.

The number of loans deemed 30 days late also declined, the first improvement to that rate in five months.

However, foreclosure starts rose, to 33,000. That’s the highest level in 18 months, but given that serious delinquencies remain low, near term risk is not high.

Active foreclosure inventory is at 217,000, but remains more than 25% below prepandemic levels.

Prepay activity is at just 0.43%.

The top five states by non-current percentage are Mississippi at 7.91%, Louisiana at 7.46%, Alabama at 5.6%, Indiana at 5.11% and Arkansas at 5.03%.

The bottom five states by non-current percentage are Colorado at 1.91%, Washington at 2.01%, Montana at 2.02% and Idaho and California both at 2.14%.

The top five states by 90+ days delinquent percentage are Mississippi at 2.11%, Louisiana at 1.81%, Alabama at 1.43%, Arkansas at 1.24% and Georgia at 1.17%.