Philly Fed Report Declares Industry Victory on Forbearance

A report commissioned by the Federal Reserve Bank of Philadelphia found more than 95 percent of the estimated 8.5 million borrowers who entered forbearance have exited.

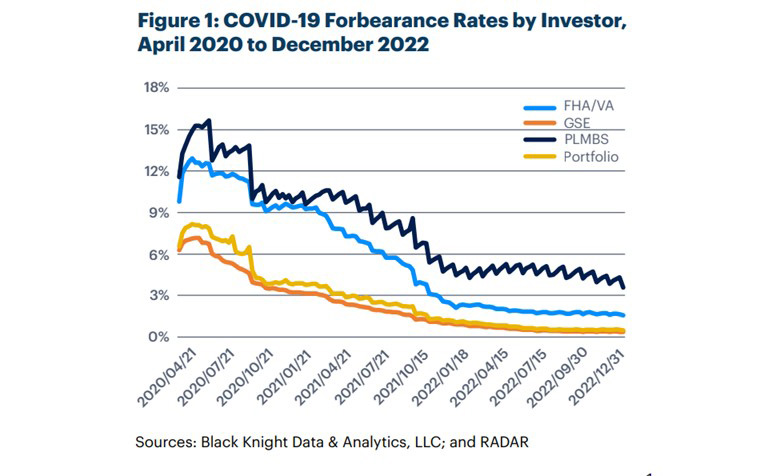

“Forbearances have dwindled to levels consistent with pre-pandemic levels for portfolio lenders and the government-sponsored enterprises, Fannie Mae and Freddie Mac,” the report said. “Our overall findings are that the program mitigated a default wave like that experienced during the Great Recession of 2008–09, as both government and private lenders participated on a broad scale to provide forbearance relief to all who requested it. And the program achieved its objectives of providing relief to those most in need of help.”

The report said of borrowers who entered forbearance and cured, nearly three-quarters of their requests were worked out in some way by mortgage servicers to keep them in their homes. “Thus, our findings show that the CARES Act Mortgage Forbearance Program with private sector participation provided short-term debt relief to those most in need, with subsequent servicer workout programs providing longer-term help to keep millions of borrowers in their homes,” the report said.

The report noted the one remaining group of sizable forbearances are the FHA/VA borrowers, with now nearly 200,000 mortgages still in forbearance.

The report was conducted by the Fed’s Risk Assessment, Data Analysis and Research Group, known as RADAR.

Last month, the Mortgage Bankers Association’s Loan Monitoring Survey reported loans in forbearance decreased by 6 basis points in January to just 0.64% of servicers’ portfolio volume as of January 31. MBA estimated just 320,000 homeowners are currently in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 0.30%. Ginnie Mae loans in forbearance decreased 8 basis points to 1.37% and the forbearance share for portfolio loans and private-label securities decreased 17 basis points to 0.83%.

MBA Vice President of Industry Analysis Marina Walsh, CMB, noted with the national emergency set to end on May 11,” many borrowers will no longer have the option to initiate COVID-19-related forbearance.” Mortgage forbearance in other forms, whether due to natural disasters or life events, will continue, with different requirements and parameters.