MBA: 4Q Commercial, Multifamily Mortgage Delinquency Rates Increase

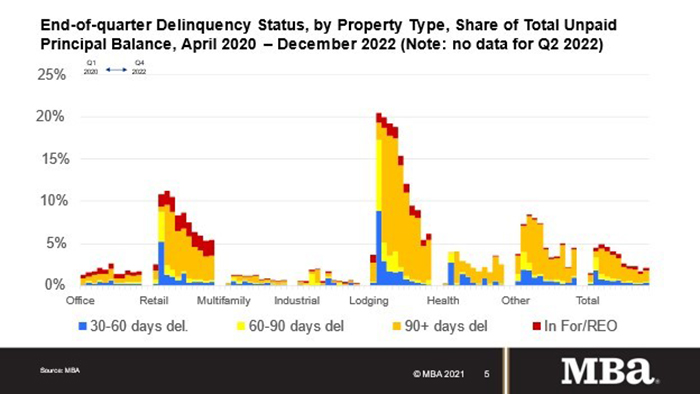

Delinquency rates for mortgages backed by commercial and multifamily properties increased slightly through the fourth quarter, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

“Commercial and multifamily mortgages continued to perform well through the fourth quarter of 2022, albeit with a slight increase in the share of loans that are delinquent,” said Jamie Woodwell, MBA Head of Commercial Real Estate Research. “Delinquency rates increased by small amounts for most property types even while the overall rate of delinquency remains low.”

Woodwell noted commercial real estate markets are going through a period of adjustment brought on by the increase in interest rates and investment yields spawned by the Federal Reserve’s actions in 2022 as well as by uncertainty about the direction of the economy in 2023. “As those changes continue to ripple through the CRE space, equity and debt markets, it’s likely delinquency rates will rise from what have been, in some cases, record lows,” he said.

Key findings from MBA’s CREF Loan Performance Survey for December:

• The balance of commercial and multifamily mortgages that are not current increased in December (compared to September).

• 98% of outstanding loan balances were current or less than 30 days late at the end of the fourth quarter, down from 98.3% at the end of the third quarter.

• 1.6% were 90-plus days delinquent or in REO, up from 1.4% six months earlier.

• 0.1% were 60-90 days delinquent, unchanged from the previous quarter.

• 0.3% were 30-60 days delinquent, up from 0.2%.

• Loans backed by lodging and retail properties continue to see the greatest stress. Both also saw upticks in delinquency rates.

• 6.1% of the balance of lodging loans were 30 days or more delinquent, up from 5.5% at the end of September 2022.

• 5.4% of the balance of retail loan balances were delinquent, up from 5.3%.

• 1.6% of the balance of office property loans were delinquent, up from 1.5%.

• 0.3% of the balance of industrial property loans were delinquent, down from 0.6%.

• 0.5% of multifamily balances were delinquent, up from 0.4%.

• Because of the concentration of hotel and retail loans, CMBS loan delinquency rates are higher than other capital sources, but they also saw improvement.

• 3.2% of CMBS loan balances were 30 days or more delinquent, down from 3.3% in September.

• Non-current rates for other capital sources were more moderate.

• 0.8% of FHA multifamily and health care loan balances were 30 days or more delinquent, up from 0.6%.

• 0.4% of life company loan balances were delinquent, flat from 0.4%.

• 0.2% of GSE loan balances were delinquent, down from 0.3%.

The MBA CREF Loan Performance survey collected information on commercial and multifamily mortgage portfolios as of December 31. This month’s results build on similar surveys conducted since April 2020. Participants reported on $2.4 trillion in loans in December, representing more than half of the total $4.4 trillion in commercial and multifamily mortgage debt outstanding.