Downsizing Tech Sector Challenges Office Recovery

CommercialEdge, Santa Barbara, Calif., reported tech companies have been laying off workers and downsizing their office footprints to cut costs, which could make the office sector’s recovery even harder.

“[Facebook parent company] Meta, for example, has already given up its presence at four office buildings and is set to give up its presence at two more–and this only since its third-quarter earnings call,” CommercialEdge said in its December National Office Report.

“But it’s not just Meta downsizing office footprints,” the report said, noting Salesforce will sublease about 40% of its 43 floors at Salesforce Tower in San Francisco and Lyft plans to sublease nearly 45% of its presence across New York, Seattle, Nashville and San Francisco.

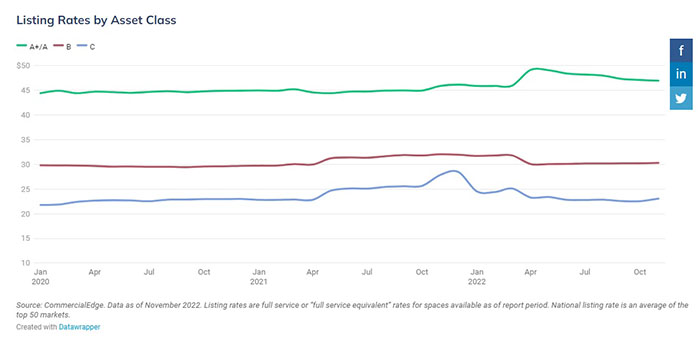

The average U.S. office listing rate stood at $38.06 per square foot, down 3.1% year-over-year, the report said. The national vacancy rate increased 110 basis points year-over-year to 16.2%.

CommercialEdge noted some giant firms such as Apple and Twitter are leading the return-to-office movement and said both small and large tech companies have eschewed fully remote work, meaning tech will remain an important demand driver.

“We’re paying close attention to work-from-office policy announcements and whether companies follow through with implementation, or if they continue to kick the proverbial can down the road,” CommercialEdge Senior Manager Peter Kolaczynski said.

“Considering the large scale of layoffs and rapid pace of office downsizing and consolidation in the tech industry–one of the most important drivers of office demand and office use in the past decade–vacancies could rise further, especially in markets with a heavy tech presence,” CommercialEdge said.

Nationally, there was 132 million square feet of office space under construction in October, or 2.1% of existing stock. Another 6.3% of existing stock was in the planning stages, despite weakening office occupancy rates driven by challenges such as hybrid work, rising costs of capital and a potential looming recession, the report said.

“In fact, the office sector is on track to have more square feet of starts in 2022 than last year, despite cancellations and postponements from large tech players,” CommercialEdge said. Nearly 56 million square feet of new office space began construction through November 2022. By comparison 58.2 million square feet of space started construction between January and November 2021.